Dire information from two iconic Chinese language property builders, Nation Backyard Holdings (2007.HK) and China Evergrande Group (3333.HK), hit the press this month. Nation Backyard missed a scheduled bond fee, its bonds stopped buying and selling and it was de-listed from the Grasp Seng Index. Evergrande declared chapter searching for Chapter 15 safety on USD 31.7BN of obligations to maintain its creditor restructuring plans on observe.

Is that this China’s Lehman Moment? The reply could rely upon what Lehman means to you. Bob Ivry, now Forbes Govt Editor for enterprise, snagged this quote from me in 2011—

Working at Moody’s Buyers Service and Hong Kong’s Futures Alternate within the Nineties, I knew even then that America’s fourth-largest funding financial institution was carrying staggering, unsustainable, typically unlawful, ranges of leverage. So, on this most simple sense, sure. Shenzhen-based China Evergrande Group (3333.HK) is a bit like Lehman: a personal, working-capital intensive firm buoyed by portfolio dimension and identify recognition, that lived past its means for years. They every collapsed in September, 2008 and 2021, a neat coincidence.

However Lehman existed to interrupt guidelines. Publish-deregulation, the U.S. had constructed up an enviable, moderately well-functioning system to fund financial progress utilizing calibrated threat and leverage in off-balance sheet financings. Lehman, the cowboy, was the exception…till the remainder of the market sabotaged itself and regulators determined to show a blind eye.

Whereas it’s possible that Evergrande needed to break guidelines every now and then to exist. China’s policymakers had lengthy acknowledged its banking system’s limitations for the large funding necessities to maintain China rising at scale. They set out the twelfth 5-Yr Plan (2011-2015) to construct new monetary system infrastructure, together with a copycat securitization market that may legitimize and regulate China’s threat and heretofore unregulated shadow banks.

The plan yielded blended outcomes. China’s securitization market features moderately effectively even now. However balance sheet private indebtedness went from 150% to 200% of China’s GDP in 5 years. And uncontrolled inventory borrowing provoked a large, humiliating collapse of China’s inventory market in 2015.

If There Was A Lehman Second, July 2021 Was It. Or Perhaps July 2022.

China’s thirteenth Plan (2016-2020) engineered a pointy shift away from developments put in movement within the Twelfth, together with capital market improvement. Of particular relevance to actual property, the Individuals’s Financial institution of China (PBOC) Three Red Lines coverage (August 2020) scuttled the trade’s widespread preconstruction gross sales mannequin that had allowed builders to fund their progress by promoting properties earlier than they have been constructed. Land gross sales in key cities with liquid housing markets have been restricted in early 2021, including a brand new layer of problem to corporations whose fundamental supply of capital is land.

These abrupt coverage adjustments conspired with the cooling financial system to knock again the heretofore worthwhile trade. Earnings bulletins in July 2021 for the primary half of 2021 have been a massacre, and a few enterprises went underneath. Evergrande held on, partly as a result of its funds earmarked for development have been diverted to pay collectors and preserve the lights on, and it stayed in a holding sample by mid-2022.

However in July, a shock creditor class revolted: the householders. They refused to go on paying their mortgage with out a house to maneuver into. Information of the boycott unfold like wildfire by China’s social media. Over 100 cities have been concerned and an estimated 5-10% of residential actual property loans in China have been affected. Authorities intervened with particular bailout funds, as a result of the political implications of remaining hands-off have been too dire. The interventions have continued into early 2023.

Non-public Capital On A Rocky Street

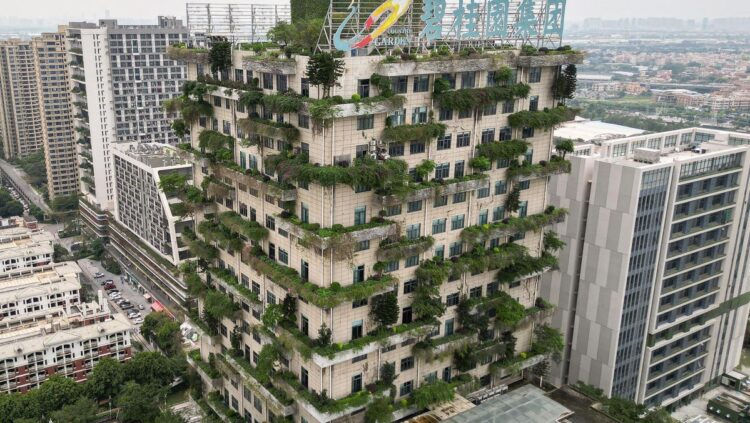

The opposite supply of dangerous information is Nation Backyard Holdings, based in 1992 and headquartered in Foshan, Guangdong—an hour by bullet practice from Shenzhen, town the place Evergrande (1996) is headquartered. Shenzhen is a brand new, fast-money metropolis contained in the Shenzhen Particular Financial Zone based in 1980. Foshan is an upgraded outdated metropolis, certainly one of China’s 4 main markets within the Ming Dynasty, birthplace of Cantonese opera and the storied gongfu grasp, Ip Man.

Nation Backyard has been a mannequin of governance for the trade and is ranked #1. But it surely too has been caught in a downward cycle, with gross sales plunging -36% between 2021 and 2022. On August 6, the developer missed two coupon funds and later introduced a internet lack of USD 6.2BN for the primary half of 2023. On August 17, Grasp Seng Indexes Co. pulled Nation Backyard Holdings from the broad market Grasp Seng Index (HSI) of Hong Kong blue chip shares, simply because it beforehand eliminated China property corporations Evergrande, Sunac, Kaisa Group, China Aoyuan and Shimao Teams, July 2022.

Nation Backyard continues to be top-ranked and solvent. It counts BlackRock, HSBC, Constancy, Allianz, UBS, JPMorgan and Apollo amongst its massive bond traders. These relationships could also be perceived as bringing particular worth to Nation Backyard as long as China continues to hunt exterior capital for home growth. However dropping out of the Index telegraphs a brand new standing for Nation Backyard, as a fallen angel.

Nation Backyard, along with Chongqing-based Longfor Properties, are the one two remaining personal capital holdouts within the rankings of China’s high 10 builders. The remaining are State Owned Enterprises, whose relative positions could proceed to rise by the top of the 14th Plan (2021-2026) given the trade’s rising reliance on authorities help and entry. This structural association comes at a probably very massive alternative value—however one which tends to maintain Lehman Moments off the file.