Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

The Financial institution of England governor has warned that government-backed proposals to water down limits on riskier mortgage lending may set off extra house repossessions and fail to assist first-time patrons, whilst he introduced plans to evaluation the coverage.

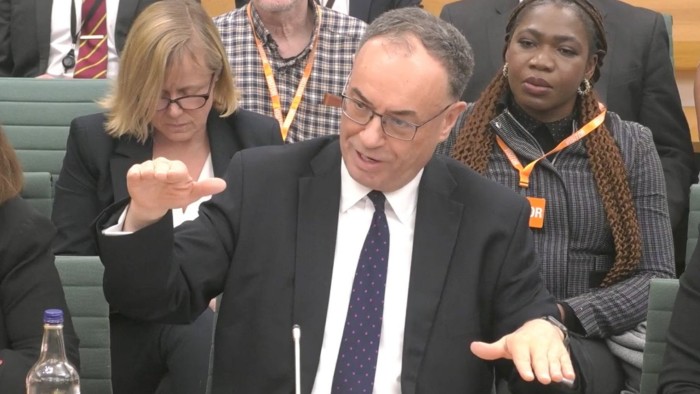

Andrew Bailey advised MPs on Wednesday he was “very pleased to have a really open public debate” in regards to the restrictions on UK mortgage lending, however stated this could take account of the “higher outcomes” the principles had offered in avoiding a surge in house mortgage defaults throughout latest shocks.

“They’ve helped to keep away from the creation of a big tail of mortgages, which, when we now have the inevitable cyclical downturn or shocks that hit the economic system, turn into an actual drawback of the type we now have seen prior to now,” Bailey stated. “So I believe that has been useful.”

His feedback point out the BoE is reluctant to additional chill out restrictions on British banks’ mortgage lending after having accomplished in order lately as November. The BoE’s sister regulator the Monetary Conduct Authority proposed going additional earlier this month.

UK chancellor Rachel Reeves backed the FCA’s proposal, telling the Monetary Occasions final week she was “completely open to concepts that may enhance house possession and assist working households get on the housing ladder”.

Reeves and Prime Minister Sir Keir Starmer have urged all UK regulators, together with the BoE and FCA, to do extra to help its aim of reviving the nation’s stagnant economic system by easing the burden of guidelines on enterprise.

Bailey advised the Treasury choose committee that he supported Starmer’s push to spice up development, however stated “there isn’t a trade-off” between this and the BoE’s major goal of preserving monetary stability.

UK mortgage lending is managed by a combination of guidelines from the central financial institution’s Monetary Coverage Committee and the FCA, most of which have been launched after the 2008 monetary disaster when a number of banks have been bailed out by the state.

The FPC limits banks above a sure dimension to lending not more than 15 per cent of mortgages price greater than 4.5 instances a family’s earnings. It modified the lending threshold of this restrict in November so it utilized to fewer banks.

The FCA requires banks to hold out affordability assessments on candidates for mortgages to make sure they may nonetheless afford the month-to-month repayments if rates of interest rose in future. The BoE ditched an analogous affordability check in 2022 as a result of it overlapped with the FCA’s guidelines.

The FCA stated a letter to Starmer this month — in response to a name from the federal government asking regulators for pro-growth concepts — that it might “start simplifying accountable lending and recommendation guidelines for mortgages, supporting house possession and opening a dialogue on the steadiness between entry to lending and ranges of defaults”.

Bailey stated the potential advantages of easing these limits additional must be balanced towards the positive factors from retaining them. He additionally warned it could do little to assist first-time patrons whose predominant impediment to purchasing a house is ceaselessly the issue in affording the mandatory deposit.

“In all of the surveys which might be accomplished, if you ask what’s the main obstacle to stepping into the mortgage market, it’s affording the deposit,” stated Bailey.

Nathanaël Benjamin, the BoE’s govt director for monetary stability technique and threat, advised MPs there was nonetheless “loads of headroom” earlier than banks hit the restrict on mortgage lending “in order that isn’t a barrier”, including that the proportion of first-time patrons in new mortgage lending was at its highest stage for 20 years.

He additionally warned that easing limits with out rising the availability of recent houses was prone to push up home costs, which might “make issues much more troublesome for households to get on the housing ladder”.