The sample exhibits up in lots of areas of the nation: growth exercise fills in between two metropolitan areas, sometimes alongside a number of highways that join them. Orlando to Tampa alongside I-4 is one other prime instance, and there are dozens extra across the nation.

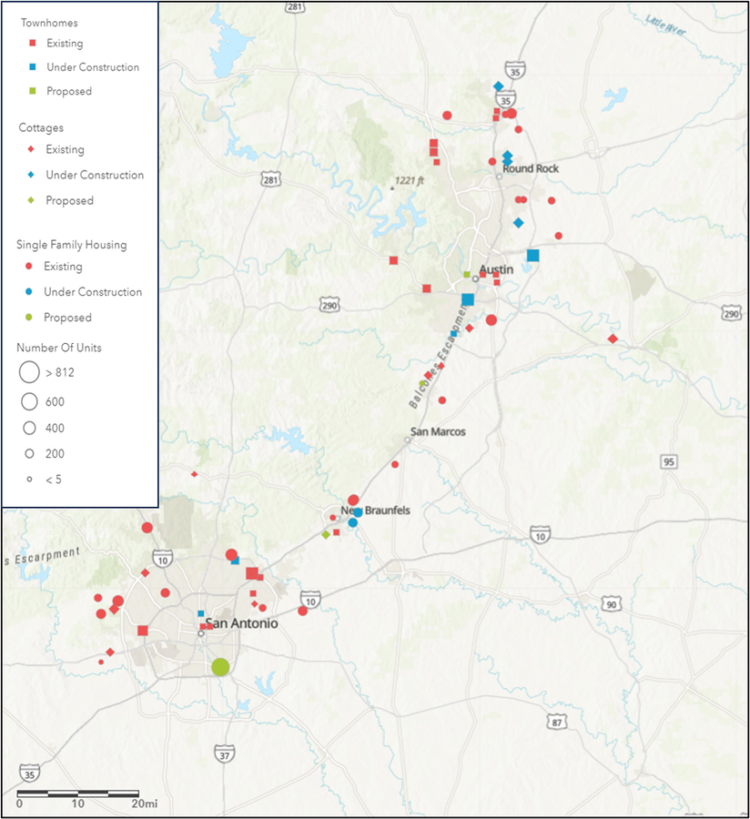

From New Braunfels to San Marcos, in addition to closer-in suburbs, the stretch between Austin and San Antonio is beginning to fill in, offering younger households and singles with a substitute for dwelling possession. The map beneath, that includes information from CoStar and supplemented by unique analysis by Hunter Housing Economics, exhibits the built-to lease (”BTR”) items which have already been constructed, in addition to these which can be beneath development and proposed in that stretch. BTR housing fills the heretofore unserved set of households who desire a suburban place with a yard or some small patch of personal out of doors area, however who can not afford (or select to not purchase) a single-family dwelling.

The stretch between Austin and San Antonio is “filling in” with proposed BTR subdivisions.

A big proportion of the BTR developments now finishing items in areas like San Marcos and New Braunfels are single-family indifferent houses, and as one will get nearer to the bigger cities of Austin or San Antonio, one finds extra townhomes and extra of the “horizontal apartment” style (additionally referred to by the extra palatable “cottages”), which supplies tenants a greater dwelling expertise than typical residences, in that they provide a ground-floor entry and often a fully-detached dwelling, with home windows on 4 sides, and a small yard. This sort of rental product is simply beginning to take off, being met by sturdy demand from singles, {couples}, retirees, and individuals who personal canine. (The benefit for canine homeowners is that they’ll let the canine out the again door as an alternative of placing them on a leash and strolling them down corridors and/or elevators to get outdoors).

Just like the cottages, built-to-rent townhomes are inclined to get developed nearer to the most important cities. Townhomes sometimes supply extra sq. footage, but in addition extra shared partitions, and are generally present in “infill” sorts of places. There may be proof of market help farther away from the most important metros, so long as they’re in good proximity to varsities and purchasing. Areas south of Austin like Buda and Kyle are experiencing sturdy inhabitants and family development, amplified by a continued migration of Californians searching for a lower-tax surroundings and decrease value of dwelling normally. New colleges are popping up there, which attraction to the brand new residents. Hire concessions that has been in impact a yr again are actually being eliminated, boosting efficient rents. Household demand is under-served on this area. Consequently, rents on new townhomes or duplexes on this space could be as excessive as $2,600 monthly for 3-bedroom items and $3,000 monthly for 4-bedroom items, in the event that they embrace effectively thought-out floorplans and higher options and facilities than the prevailing houses within the space. The fee to personal comparable items is near $3,200 monthly.

There’s a vital lease premium over individually-owned rental houses, significantly houses that aren’t in a master-planned neighborhood. Analysis by Hunter

Survey of Renters, 2023, displaying the assorted sorts of premiums of latest BTR over scattered SFR and … [+]

Housing Economics this yr quantified the premium within the southern U.S. as $265 monthly. On a proportion foundation, renters are keen to pay 13.3% extra for a newly constructed rental townhome than one that isn’t new, in accordance with the survey outcomes. The premium over a rental condominium in the meantime got here in at 24.3%.

Within the space north of San Antonio, BTR tasks resembling Pradera, Village at Vickory Grove, Eschelon at Monterrey Village, and Springs at Alamo Ranch have carried out effectively. Rents on this space can rise up to $2,500 monthly.

One other instance of this sample of “filling in” between main cities is in Florida, alongside the I-4 hall between Tampa and Orlando. This map exhibits the built-for-rent

The realm between Tampa and Orlando is simply beginning to fill in, and the built-to-rent developments … [+]

developments that exist already in Tampa, extending principally northward proper now. From the opposite course, spilling out of Orlando, there have been some BTR tasks in Kissimmee and St. Cloud, due south of Orlando, and in addition to the west, principally close to Interstate-4.

Constructed-to-rent growth exercise is slowing now, and we will definitely see a pointy discount in BTR begins subsequent yr, attributable to a scarcity of capital. Builders who’re planning tasks to enter the market in 2025/2026 are more likely to discover a smaller variety of tasks opening up round them. A few of our purchasers are stepping into place to select up what would possibly emerge as “distressed” BTR tasks subsequent yr, when it’s anticipated that some traders who tied up land will discover themselves financially unable to shut on the acquisition. The dearth of capital on this area might signify a possibility for well-capitalized traders to select up a contract or in any other case get right into a deal that isn’t presently out there. Subsequent yr ought to be an attention-grabbing one for BTR traders and builders.