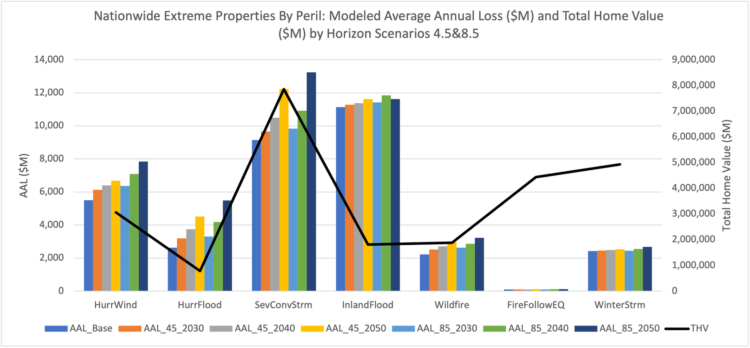

This graphic reveals the rising danger to properties and the greenback valuation of the harm to these … [+]

For a lot of the U.S. inhabitants, summarizing a house as shelter is a reasonably gross underrepresentation of what a house really delivers, however now many are searching for shelter from extra excessive local weather occasions which might be able to decreasing our present housing to underperforming shelters.

Whereas the challenges have all the time existed, world actual property information platform CoreLogic studies ever-increasing dangers and that now greater than 18 million properties valued at $8 trillion are at excessive danger.

There are mechanisms in place for cover, comparable to constructing codes, insurance coverage, higher forecasting, and new design with higher performing supplies, nevertheless, even these mechanisms are proving to have failure factors, and typically main gaps.

Rising Dangers

Dangers are outlined in some ways, and to make issues much more sophisticated, housing stakeholders have a look at them by way of utterly totally different lenses. A house insurance coverage firm evaluates danger in another way than the builder, who’s totally different than the home-owner, who’s totally different than the architect. These disparities actually don’t assist the state of affairs, however on the similar time, not one of the stakeholders can argue with the looming hazard of stronger climate occasions.

CoreLogic’s information analyzes property-level bodily attributes, property-level monetary information, particular peril impacts, and a wide range of local weather situations, to grasp the present and future monetary impression. The corporate’s information additionally takes the age of the housing inventory under consideration, making each granularity and scale necessary within the outputs.

“What CoreLogic does is establish the monetary danger for each property within the U.S.,” stated Anand Srinivasan, who acts as govt of innovation at CoreLogic. “If the property is bigger than 100 sq. toes, then we’ve got calculated loss estimates and created danger scores that incorporate current and future local weather danger. Now, we’re getting demand from authorities officers to have a look at longer durations due to capital investments.”

The information gives a holistic view of all potential hazards, together with floods, hurricane winds, wildfires, extreme convective storms, extreme winter storms, together with earthquake exercise. From there, the info may help establish the highest dangers in monetary phrases by potential loss, making CoreLogic a great tool for insurance coverage corporations and mortgage originators in underwriting and monetary evaluations of properties and insurance policies and portfolios of properties.

The information is complete and overwhelming, however the worth of the info is important to all of the stakeholders.

“We have a look at the delineation between protection quantity and the mortgage quantity, the house worth, the fairness worth, and the reconstruction prices,” Srinivasan stated. “And, all of them are transferring targets, however it helps articulate the chance after which helps outline actions on what may very well be carried out to cut back the chance and has an impression on what the proprietor would do.”

There are dozens of examples. As an example, the Federal Reserve Board has printed a paper utilizing CoreLogic information to establish what destroys a neighborhood, outlined by the tipping level for shoppers to stroll away from their broken property as a result of the harm is just too intensive. There have already been cases when a home-owner would select to make use of their insurance coverage cost to repay any remaining mortgage after which stroll away. This type of information may very well be the catalyst for a neighborhood renovation, funding or what has tragically occurred, insurance coverage leaving the world.

To grasp the info a bit of higher, CoreLogic defines “excessive danger” properties as these having a local weather danger rating of higher than or equal to 70 out of 100 in any time horizon, or as having a shift in local weather danger rating between any two time horizons of higher than or equal to 40. High metrics mentioned right here embrace all dangers collectively, however are outlined for every peril as properly, and exceeding the restrict for any one in every of them defines the property as excessive.

The corporate additionally makes use of the time period “grave hazard” to focus on the magnitude of properties and {dollars} concentrated in these geographies when in comparison with nearly all of different geographies within the U.S., however has not but refined their standards as detailed as “excessive danger.”

The information additionally may be represented over totally different time horizons to seize a future spike, comparable to a flood in an space at the moment struggling a protracted interval of drought, which once more may very well be a catalyst for a neighborhood retrofit venture.

In CoreLogic’s evaluation of all markets throughout the U.S. of utmost danger properties, the reconstruction price or the {dollars} wanted to rebuild the house in a complete loss occasion, and the whole dwelling values or what the house would promote for right this moment, it studies a complete of 18 million properties valued at $8 trillion with California, Florida and Texas every carrying between 2.5 and three.8 million properties.

The worth in danger within the Miami space is the very best within the nation and so are the property counts. Of all the acute danger properties within the nation, about 12% of the models and the worth reside in Miami right this moment at 1 million properties with $$814 billion in worth, and that danger stays sturdy over time.

The San Francisco space has a barely decrease share of utmost danger homes, however the properties are valued larger on a per home foundation, with half one million properties with $600 billion in worth in danger. The identical goes for San Jose, with 333,000 properties valued at $450 billion and Los Angeles with 383,000 properties valued at $356 billion.

Texas is experiencing the alternative phenomenon with a better proportion of properties in danger, however which might be valued decrease. So, the very best worth of destruction is within the three California cities and the very best inhabitants impacted could be within the Dallas and Houston areas.

With no mitigation to extend property resiliency with will increase in local weather danger, a danger rating will change from 15 to 54 out of 100 by 2050. Almost 300,000 mannequin runs of impacts are replicated on the property to venture common loss price in a single 12 months.

Danger scores present a normalized technique to simply evaluate danger throughout geographies and time with out having to do all the maths, and a further rating is used to calculate {dollars} of loss based mostly on the publicity, which is the reconstruction price.

The Failing Position of Constructing Codes

This overhead view of two adjoining properties reveals how a fence can act like a wick main wildfire … [+]

Whereas constructing codes are in place for an excellent cause, the event of the codes and the administration of the codes include many challenges.

Ian Giammanco serves because the managing director of normal and information analytics and lead analysis on the Insurance Institute for Business and Home Safety and explains that constructing codes may be adopted and enforced at quite a lot of ranges, with state-level constructing codes standing out as the one to be uniformly enforced. Native and county codes change into a bit extra haphazard of their enforcement.

“We advocate for statewide code as a result of it’s uniformly enforced and it’s simpler for all,” he stated.

He gives a robust instance. In Florida in 1992, there have been many variants of constructing codes at state, county and metropolis ranges, inflicting conflicts and misunderstanding, so the enforcement was not as sturdy because it ought to have been. These disparities had devastating penalties when the strongest hurricane in Florida’s historical past hit in 1992 when Hurricane Andrew hit, leading to probably the most deaths and the very best greenback of destruction in historical past.

“Codes are there for the communities of tomorrow, in order that they must be in place earlier than we construct,” Giammanco stated. “Each three years code will get up to date. They must be up to date repeatedly in order that the newest engineering and science is in there.”

As hurricanes proceed to batter properties in Florida, the constructing code improves and now it often is ranked as first or second when it comes to effectiveness nationwide.

“Following Hurricane Ian in 2022, we checked out 3,600 properties, 455 of which had been constructed below the trendy Florida Constructing Code, and none had structural harm,” he stated. “It reveals that the work that’s being carried out is efficacious and highly effective.”

In different excessive occasions, like wildfires, constructing codes have a protracted approach to go.

“Wildfires hit from the skin in and constructing codes often cope with fires that ignite inside a property,” he stated. “Solely two states, California and Utah, have a wildfire-centric code in place right this moment that’s efficient to guard exterior in.”

With the age of right this moment’s housing inventory, retrofits and renovations can be important to guard residents from future occasions. The constructing codes for these remodels is more durable to handle and to encourage participation with as a result of householders must decide to the upfront prices.

An excellent instance of that is the FORTIFIED program that has three ranges and roof substitute is one in every of them. When a home-owner elects to reroof their dwelling, it gives a very good alternative to do one thing stronger or higher. Giammanco has seen profitable incentive applications that can cowl the associated fee differential or a declare to cowl the added price to go to a FORTIFIED roof in order that the home-owner isn’t liable for the additional expense, however will get higher safety.

Insurance coverage Impacts

This dwelling was constructed to the FORTIFIED normal, a voluntary beyond-code development technique that … [+]

The CoreLogic information consists of 110,000,000 single household residences and, sadly, there isn’t a industry-wide accessibility to which properties have insurance coverage that might result in smarter, safer communities.

“We really may get at analytics if there was industry-wide data on identify of the insurer and the protection A quantity on the precise coverage,” Srinivasan stated. “That might go a great distance in figuring out below insured gaps. With the huge quantity of loans being authorities backed, it’s shocking there isn’t simply accessible information on it.”

Having that data would utterly remodel this house that’s extremely tough to handle at the moment with such little transparency.

One means to assist right this moment could be to develop extra precision in how loss is predicted in order that the insurance coverage corporations could make applicable choices.

“The non-public insurance coverage market is what individuals actually need to get the choices for the very best value and we’ve got to take care of that,” Giammanco stated. “With the altering panorama due to local weather, we’ve got to make buildings stronger. Insurers are going to have a look at new merchandise – like parametric insurance coverage that’s already in business house and may transfer into residential the place the occasion severity triggers the appropriate protection.”

To assist clear up these equations, there’s a want for higher constructing envelope supplies together with higher check requirements to enhance these supplies. Then, these supplies must be deployed out there at an affordable value to scale up. As an example, composite supplies are good at stopping hail harm however are nonetheless too costly.

Within the case of fireplace, it’s extra sophisticated and depends on a system the place insuring particular person properties doesn’t clear up for the problem.

“Why fireplace is so scary is that in suburban neighborhoods, the codes didn’t account for it,” he stated. “The neighborhood situation is tough as a result of if two properties are shut collectively and one is ideal however has one weak spot it may be exploited as a result of the neighbor did no mitigation. For us to deal with fireplace we’ve got to do it at giant scale – neighborhood, neighborhood scale to drive it.”

Alabama and Louisiana lately applied a really profitable retrofit grant marketing campaign to deliver properties as much as code and forestall future harm. The states joke that their grants promote out quicker than Taylor Swift live performance tickets.

After the 2005 hurricane season, Alabama acknowledged it needed to do one thing to take care of a very good non-public insurance coverage house. Launching the Good House Alabama program to drive shopper demand to set a benchmark of the minimal that you can do to construct to the FORTIFIED normal.

Development began to kick in as builders caught on and native jurisdictions acquired concerned. The grants acquired extra funding and particular person insurance coverage carried past.

“Virtually 1 / 4 of all properties in these counties are actually constructed to that normal,” he stated. “Greater than 45,000 properties in these two counties have the designation of being FORTIFIED. It wasn’t simply insurance coverage, it was incentives. Grants are like urgent a button for consciousness.”

Growing New Defenses

Throughout the pond, William Swan and his crew at Energy House 2.0 have developed one of many world’s most refined testing facilities that assist producers and {industry} gamers perceive local weather impacts on a wide range of scales.

“We have to construct a brand new product,” he stated about right this moment’s housing. “The product beforehand constructed has been constructed for a lot of, a few years and there are points round financing, insurance coverage, between builders and power suppliers. The enterprise fashions are altering, so all of the underlying institutional frameworks have to regulate.”

Snow covers the bottom of a testing chamber on the College of Salford’s Vitality Home 2.0 testing … [+]

On the Vitality Home there are testing chambers the place the crew can assemble a complete constructing, giving a holistic image of the inputs, whereas additionally decreasing the size and the expense of discipline trials. Wind, snow and photo voltaic may be measured within the chamber exhibiting impacts on temperature, and the relative humidity.

“On the lab, you possibly can compress the time to undertake analysis by controlling the climate and by doing repeated experiments,” Swan stated. “There are extra information to see why issues labored, not simply in the event that they labored, which is tough within the discipline. We additionally may change the home as wanted, power programs, boilers, alternative ways to manage, EVs, renewables and the way all this stuff work together and even right down to what distinction does carpet make to power effectivity.”

Swan says the testing is all concerning the future. For instance, Vitality Home is working with the homebuilders Bellway and Barratt to check the product they are going to be providing in 2025.

“The calls for on the efficiency of these buildings is way larger,” he stated. “They’ve been constructing the identical factor for 50 years, however future dwelling requirements implies that they can not use fuel and the requirements for constructing are a lot larger, which can be tough to scale utilizing conventional constructing strategies.”

The longer term additionally means points that aren’t prevalent right this moment, like overheating and making properties very water environment friendly to cope with droughts. The brand new extremes with hurricane power winds are very tough however may be examined within the chambers, together with flooding by constructing a concrete base round the home and filling it with water.

“When the properties are constructed, we put sensors within the partitions, and every dwelling has almost $50,000 of sensors so each circuit or factor may be monitored,” he stated.

The sensors present information that’s then collected and analyzed. Then, Vitality Home distributes the brand new data to the {industry} at giant to tell regulatory requirements teams and coverage our bodies. Offering the analysis and doing the science is within the lab’s knowledgeable fingers however leaves a basic accountability to the builders.

“As a lot as we’re doing the science, the builders want to inform a narrative that the shoppers can perceive and make as usable as doable,” Swan stated.

Innovation is gaining floor, with properties comparable to this cantilevered design that may survive floodplains – a terrific story for a house purchaser. Here are three different housing improvements that stand as much as probably the most aggressive hurricane forces.

As the long run information predicts, we must be ready – with smarter merchandise, programs, and applications. Sport on.

![Mobidea Facts & Figures [Updated 2026 ]](https://18to10k.com/wp-content/uploads/2026/01/Mobidea-Facts-and-Figures-120x86.png)