A bank social media coverage is crucial for any monetary establishment to guard in opposition to authorized and reputational dangers.

Inappropriate worker, buyer, or vendor posts can severely injury a financial institution’s popularity and end in regulatory charges – as can monetary misinformation, poor customer support responses, and violations of buyer privateness.

Creating an efficient financial institution social media coverage means accounting for all potential risks associated with using social media. It could actually additionally embody coaching, audit processes, worker protocols, and extra.

Listed below are some ideas for creating and implementing a profitable social media coverage for financial institution workers.

Bonus: Get a free, customizable social media policy template designed specifically for banks to quickly and easily create guidelines for your financial institution.

Financial service institutions have a accountability to guard their clients’ information, preserve the integrity of their providers, and handle their reputations. A social media coverage helps be sure that financial institution workers take acceptable steps when utilizing social media on behalf of the establishment.

Making a financial institution social media coverage can:

Shield a financial institution’s popularity and model

Tens of millions of conversations occur every single day on social media. Prospects, workers, distributors, and extra could also be speaking a couple of financial institution on-line. Clear social media insurance policies are necessary for establishments to deal with suggestions and detrimental conversations proactively. These insurance policies ought to outline acceptable and inappropriate conversations and the way to handle detrimental suggestions.

Safeguard buyer info and information

Social media can be utilized to distribute delicate details about clients, similar to account numbers and monetary statements. A transparent coverage outlining what sort of buyer information is allowed on social networks helps defend non-public information.

Assist workers use social media responsibly

In lots of circumstances, financial institution workers grow to be accountable ambassadors of their group on social networks. By establishing tips for worker conduct, banks may help be sure that employees members don’t submit inappropriate or unprofessional content material on-line.

Enhance customer support

Trendy banking clients look forward to finding, talk, and problem-solve with their banks on-line. Financial institution social media insurance policies create tips round how customer support needs to be addressed on social media, similar to responding to questions in a well timed method and being respectful when coping with buyer points. This helps guarantee clients obtain superior service and assist, even when utilizing digital channels.

Simplify disaster administration

Social media generally is a double-edged sword throughout a disaster. Financial institution insurance policies for social media allow banks to take swift motion when wanted and protect their brand from any potential injury attributable to detrimental posts or feedback.

With tips in place, it’s simpler to handle any PR emergencies whereas remaining skilled and defending the model. So, hopefully, all of us keep away from the subsequent Silicon Valley Bank Twitter-fuelled bank run. Yikes.

Keep compliant and keep away from authorized missteps

Banks are required to adjust to a number of legal guidelines and laws. A financial institution social media coverage ensures that banks adhere to business requirements in all communications, together with on social media platforms. This helps make sure the financial institution is compliant with relevant regulations and has a popularity for being dependable and reliable.

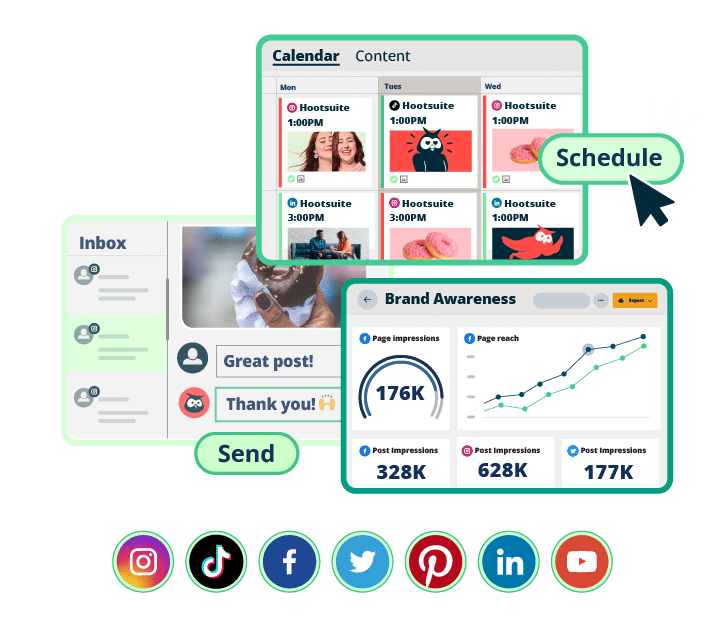

#1 Social Media Tool for Financial Services

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

Whereas financial institution social media insurance policies might have cross-over with general social media policies, there are some key components to think about when writing a coverage particular to a financial institution.

Listed below are among the prime options banks ought to embody of their social media insurance policies:

1. Lively channels and worker entry

A financial institution’s social media coverage ought to start by outlining all of the energetic social media platforms utilized by the financial institution and the way workers can entry them. It also needs to clarify who is allowed to submit on every platform, how content material needs to be accepted and another guidelines for managing official channels.

2. Regulatory and compliance

Earlier than workers have interaction with clients or submit content material, they want to pay attention to any related legal guidelines, laws, or guidelines set out by authorities businesses and business associations. This would possibly embody The Bank Act in Canada, or the Consumer Financial Protection Act in the USA.

Ensure to incorporate all related regulatory and compliance necessities in your coverage so workers know what’s required of them when posting on behalf of the financial institution. This would possibly embody avoiding false or deceptive statements, disclosing account numbers and different required info, and abiding by the financial institution’s code of conduct.

3. Applicable conduct

The web by no means forgets, and there’s no scarcity of examples of social media posts touchdown corporations and workers in critical scorching water.

However inside flubs aren’t the one factor to be careful for on the subject of social media. When workers submit on any sort of social media whereas representing the financial institution, they have to be conscious that their posts may affect buyer opinion and belief within the enterprise.

By making a financial institution social media coverage, you possibly can set expectations round acceptable conduct on-line, similar to avoiding offensive or controversial content material, adhering to the identical customer service expectations on-line as they do in-person, and refraining from interacting with disgruntled clients.

As well as, be certain your coverage gives steering on how workers ought to establish themselves when posting on social media (e.g., not utilizing their official financial institution electronic mail), how they need to deal with delicate info and any authorized tips they have to observe.

Your coverage also needs to word that workers needs to be cautious about how a lot info they share on-line. Discretion and professionalism are key when posting on social media as a financial institution worker. coverage will be certain all employees perceive the expectations set ahead by their employer.

4. Disaster administration

Social media crises are a reality for any establishment. Irrespective of how rigorously you craft your social media and customer support insurance policies, there are sure to be instances when clients or members of the general public have a detrimental response to your on-line presence.

You’ll want to element the way to take care of public crises, political crises, buyer crises, and inside crises. You might also wish to set up a sequence of command that workers can observe for recommendation and steering throughout instances of disaster.

5. Privateness and confidentiality

Lastly, a financial institution’s popularity hinges on shopper belief. It’s paramount that banks defend buyer info and ensure it stays confidential to forestall any privateness breaches.

A financial institution social media coverage ought to embody tips on how workers are anticipated to deal with buyer information and the way to defend them from potential safety dangers.

Bonus: Get a free, customizable social media policy template designed specifically for banks to quickly and easily create guidelines for your financial institution.

Looking for examples of great examples of bank social media policies? Here are a few to get you started.

1. Bank of Canada

Social media policies don’t have to be complicated, but they do have to be detailed.

The Bank of Canada outlines its social media policy on a thorough web page out there publicly to workers and customers.

The coverage begins by outlining which social platforms the Financial institution of Canada formally operates on, who manages them, and the communication requirements anticipated from each financial institution workers and clients.

This financial institution social media coverage additionally provides clear expectations on the way to correctly use hyperlinks and endorsements. Plus, what sort of language use and accessibility clients can count on from its platforms.

Supply: Bank of Canada

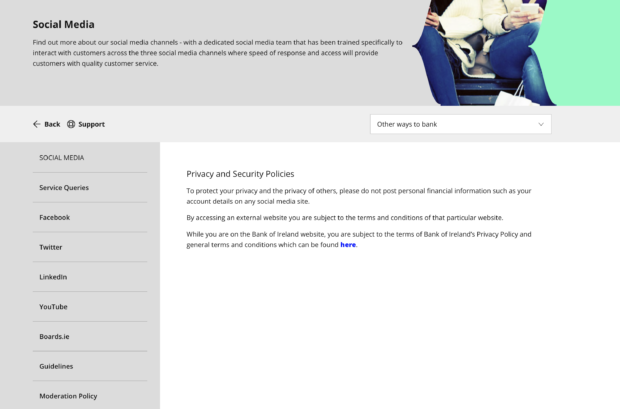

2. Financial institution of Eire

Throughout the pond, the Bank of Ireland outlines its financial institution social media coverage in a graphic, interactive webpage.

Supply: Bank of Ireland

This financial institution social media coverage outlines strict guidelines about what’s and isn’t acceptable from Financial institution of Eire accounts. This contains declining to present monetary recommendation or recommendation on merchandise over social media, in addition to when the financial institution chooses to average or censor sure content material.

Supply: Bank of Ireland

There are additionally clear breakdowns for every of the financial institution’s energetic social channels: Fb, Twitter, LinkedIn, YouTube, and Boards.ie, so each customers and workers perceive why and the way these channels are used.

Supply: Bank of Ireland

3. Royal Financial institution of Canada (RBC)

Social media coverage is commonly intertwined with different inside discussions round ethics and integrity.

Within the case of RBC, these concepts had been so related that they packaged each into a detailed, visual PDF package that outlines expectations from RBC workers and clients on all channels.

Supply: RBC

The PDF aligns social media coverage with RBC’s wider imaginative and prescient and values, explaining why and the way these values are utilized to inside and exterior communications.

Worker use of social media, each enterprise, private, and company, is printed as a necessary a part of a wider dedication to integrity.

Supply: RBC

The visible design and values-aligned copy make this financial institution social media coverage a breeze to learn, and a memorable asset.

It’s one factor to construct a financial institution social media coverage, but it surely’s fairly one other to place it into motion. Listed below are 5 steps to assist guarantee profitable coverage implementation:

- Share the coverage: Ensure all financial institution workers are conscious of the coverage by distributing a replica and offering clear directions on the way to observe it.

- Educate and practice: Present coaching periods and ongoing reminders in regards to the coverage and its significance. It will assist be sure that everybody is aware of and understands their duties.

- Monitor compliance: Recurrently test worker exercise on social media platforms to make sure they’re following the coverage. If workers are discovered to be in violation of the coverage, take disciplinary motion as wanted.

- Evaluation and replace: As social media evolves, so ought to your financial institution’s coverage. Ensure to evaluation and replace it usually to be able to stay-to-date with adjustments.

- Take suggestions severely: Encourage workers to present their suggestions on the coverage so that you could make crucial adjustments as wanted.

- Use the correct instruments: A social media coverage is simply as profitable as its every day implementation. Utilizing the correct social media administration device may help your workforce observe your coverage, submit posts for approval, and monitor content material for compliance on the go. Right here’s how Hootsuite helps social groups within the monetary providers business:

What banking regulation covers social media?

Relying in your nation of operation, completely different banking laws might cowl social media use. Listed below are only a few:

- USA: Fair Lending Laws, together with the Equal Credit score Alternative Act/Regulation B2 and Truthful Housing Act.

- UK: FG15/4 from the Monetary Conduct Authority (FCA).

- Australia: RG 271 from the Australian Securities and Investments Fee (ASIC).

- Canada: The Bank Act.

Contact your native governing authority to be taught extra.

What are the ethics for social media by financial institution workers?

Financial institution workers ought to perceive that their actions on social media can have a direct affect on the financial institution’s popularity and may, due to this fact, observe a number of moral guidelines when posting.

This contains:

- Respecting confidentiality: Follow basic matters that don’t breach buyer privateness.

- Conserving it related: Be aware of what you submit and who your viewers is – attempt to not submit content material that’s of a private nature or unrelated to your financial institution.

- Refraining from detrimental feedback: Keep away from making disparaging remarks in regards to the financial institution, its providers, and different clients.

- Sustaining professionalism: Pay attention to any phrases and situations within the financial institution’s social media coverage. Make sure you preserve posts freed from offensive language and preserve respect for different customers.

What’s the position of social media in banking?

Social media in banking is an effective way for banks to interact with their clients, construct belief and loyalty, present customer support, and keep present on the newest traits in banking. It additionally helps banks showcase their services, in addition to preserve updated with business developments.

Hootsuite makes social advertising and marketing straightforward within the monetary providers business. From a single dashboard, you possibly can handle all of your networks, drive leads, present customer support, mitigate danger, and keep compliant. See the platform in motion.

Get extra leads, have interaction clients and keep compliant with Hootsuite, the #1 social media device for monetary providers.

![How to Write a Bank Social Media Policy [Free Template]](https://18to10k.com/wp-content/uploads/2023/06/bank-social-media-policy-750x750.png)

![3 Tools to Use Instead of Facebook Analytics [2024 Edition]](https://18to10k.com/wp-content/uploads/2023/11/Facebook-analytics-350x250.png)

![Mobidea Facts & Figures [Updated 2026 ]](https://18to10k.com/wp-content/uploads/2026/01/Mobidea-Facts-and-Figures-120x86.png)