As an increasing number of folks come again into their workplaces, the utility of getting a house within the metropolis … [+]

New York Metropolis actual property’s third quarter has taken each patrons and sellers on a wild trip. After an lively early spring, the market entered June with a bang; the Olshan Luxury Market Report, monitoring offers over $4 million in Manhattan, confirmed 31 transactions in every of June’s first two weeks and 32 within the third week. The identical dynamism held true for smaller items as properly, with studio and one bed room items, priced proper, staying in the marketplace solely a few weeks.

Because the summer season moved on, nonetheless, an ideal storm of situations impacted transaction quantity in an virtually unprecedented method. Within the first week of June, Olshan reported 31 transactions; in June’s fourth week there have been 29. Within the second week of July it fell to 24; through the week of July 31 it fell once more, to 19 transactions. And the week of September 11 noticed 10 offers made, whereas final week, beginning September 18th, noticed 8. This precipitous decline can’t be attributed to seasonality alone; a number of elements got here into play.

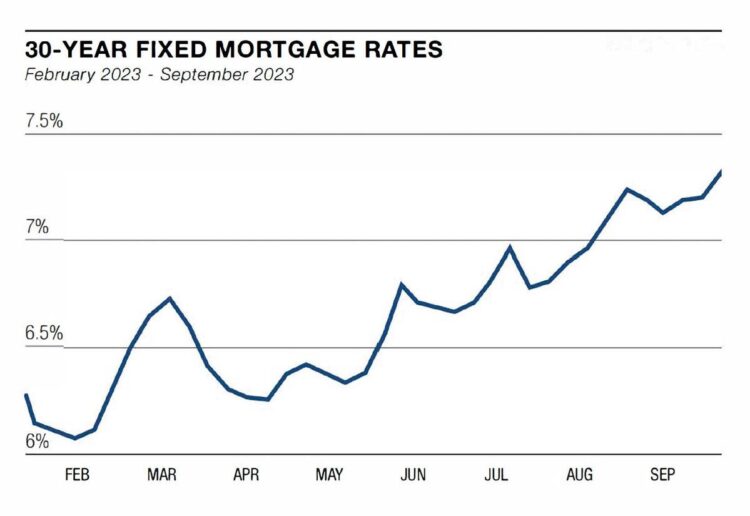

30-Yr Fastened Mortgage Charges | February 2023-September 2023

First, in fact, is the rise in rates of interest. In line with Freddie Mac, the price of a 30- yr mounted price $300,000 mortgage, which stood at 6.09% initially of February, has soared as of Thursday September 27 to 7.31%. This enhance, which displays the Fed- eral Reserve’s ongoing effort to tame inflation, impacts actual property markets in a number of methods. Most clearly, it inhibits patrons: loans which might be had for two.75% in 2021 in the present day price over 4.5% extra! Many first time patrons merely can not afford the massive incremental price.

However sellers are impacted too, particularly those that purchased or refinanced within the submit recession interval. Since only a few mortgages are transferable, sellers need to be both debt free or extremely motivated as a way to quit a mortgage price underneath 3% to imagine a brand new one at over 7%. So owners, in growing numbers, are transforming and staying put. This in flip cuts down drastically on the availability of accessible stock for patrons to think about. Whereas low stock often drives dwelling costs up, that has not been the case right here in New York Metropolis. Nonetheless, strange folks transferring to New York should cope with a triple risk. They’re trapped between low stock which makes it exhausting for them to search out the house they need, excessive rates of interest which make buying that dwelling far more costly, and a decent AND expensive rental market.

HELOC & Dwelling Fairness Mortgage Dedication by Identified Borrower Utilization

Towards this complicated background, the common dramas of shopping for and promoting play out. Although costs in New York haven’t risen for years, sellers nonetheless usually maintain on to a fantasy worth for his or her dwelling which isn’t in keeping with market realities. On the identical time, patrons, as a result of costs in New York haven’t risen for years, consider that reductions ought to be better than {the marketplace} suggests. Co-ops in want of renovation stay the perfect worth play within the metropolis: between the onerous board course of, the necessity for approval of renovation plans, provide chain points, and busy contractors, renovation prices and timelines are sky-high. And but, offers are getting completed. Properly-priced properties can promote shortly as low provide drives extra patrons in direction of fewer listings. Brooklyn continues to thrive because it stays the borough of alternative for patrons underneath fifty, a lot of whom have dad and mom or grandparents who fortunately left Brooklyn behind for Manhattan a long time in the past. A well-staged, cleverly marketed, well-priced house is at all times fascinating. And whereas most patrons settle for that there isn’t any assure of huge will increase in worth over the following 5 to 10 years, they nonetheless need a spot they’ll name their very own.

Trying in direction of the fourth quarter, we don’t anticipate important modifications. The mar- ket over $10 million will proceed to be gradual, characterised by value reductions and rotating brokers as sellers turn out to be more and more frus- trated. Consumers, hemmed in by excessive rates of interest and stock shortages, anxious concerning the state of the world and the nation, will step up solely once they discover the suitable factor on the proper value. For some, that may take a yr or much more. However as an increasing number of folks come again into their workplaces, the utility of hav ing a house within the metropolis continues to rebound.

And in any case, New York is at all times the one and solely New York.