From rates of interest and financial indicators to world occasions and native work patterns, the market’s … [+]

Manhattan, the center of New York Metropolis, is a focus of world actual property curiosity, and its dynamic market displays varied financial, social, and geopolitical elements. Given its relative significance, listed below are 5 vital areas or elements poised to affect the Manhattan actual property market within the upcoming months. By means of a mixture of data-driven insights and market traits, this piece makes an attempt to offer some indications of the potential instructions the Manhattan market would possibly take within the months forward.

No. 1: Curiosity and Mortgage Charges

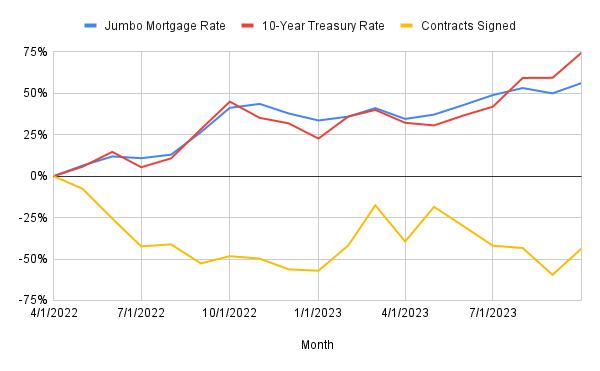

With the interaction between the Federal Reserve’s goal fee, the 10-year Treasury yield, and mortgage charges, important shifts in these charges can affect the Manhattan actual property market. Discover the sizable constructive transfer in charges in contrast with the downward transfer in contracts signed. Whereas the correlation between mortgage charges and demand is negligible, the traditionally important fee motion has definitely compelled patrons to reexamine affordability questions.

What we’re watching: If the Fed Funds futures, as they stand right this moment, are appropriate, and the Fed begins to chop charges in Might or June subsequent 12 months, we could begin to see a lower in mortgage charges. Such a situation can doubtlessly enhance demand, particularly in a market that’s not oversupplied, as current expectations about future prices turn out to be extra manageable.

% Change Since April 2022

No. 2: The Energy of the Basic Economic system

The S&P 500, usually seen as a barometer for the overall economic system, offers insights into the well being and route of the broader market. If rates of interest stabilize or decline, the inventory market would possibly expertise one other leg up, doubtlessly driving extra demand in the actual property market. A buoyant inventory market usually alerts elevated shopper confidence, which normally interprets to extra exercise in the actual property sector. Regardless of rising charges and recessionary threats, the S&P 500 has proven exceptional adaptability since January 2022, suggesting a resilience that underscores the US economic system.

What we’re watching: If the economic system manages to keep away from a much-predicted recession and customers stay sturdy, the wealth impact could come again into play and drive Manhattan gross sales as soon as once more, particularly within the luxurious sector.

Manhattan Contracts Signed vs. S&P 500 | Truncated at +100% to point out element

No. 3: The 2024 Presidential Election

Historic knowledge reveals a noticeable development within the Manhattan actual property market round election durations. There is a tendency for each provide and demand to dip. Whereas this can be on account of uncertainties related to elections, it’s seemingly extra of a seasonal impact because the Manhattan market normally begins slowing down for the vacations across the similar time. Both method, patrons and sellers are inclined to undertake a cautious strategy to the market, resulting in decreased exercise. Submit-election readability units in across the similar time because the busy spring season begins. Manhattan normally sees a burst of exercise in March/April, which is extra seemingly on account of seasonal patterns versus waning uncertainties.

What we’re watching: If the 2024 election turns into one other diametric alternative on coverage, patrons could pause to attend it out, forcing must-sellers to chop costs to drive demand.

No. 4: Geopolitical Uncertainties

International occasions, particularly in areas just like the Center East and Ukraine, can solid ripples throughout world markets, together with actual property. Whereas the direct correlations might be intricate, such geopolitical tensions generally lead buyers to hunt security.

What we’re watching: If occasions start to solid a extra world shadow, we may see elevated demand for safer, US-dollar-denominated belongings, which may translate right into a bid for Manhattan condos from overseas buyers.

No. 5: Return-to-Workplace Dynamics

The evolving panorama of labor, particularly the hybrid mannequin, has led to important adjustments in Manhattan. In response to a white paper by foot site visitors analytics agency Placer.ai, the share of Manhattan employees again within the workplace recovered to greater than 80% of its January 2020 degree in June. Though this quantity has seemingly stalled at these ranges, it does recommend that the earlier work-from-home mentality in 2021 and early 2022 didn’t considerably deter transactions and that additional positive factors may assist revive the financial well being of native companies, constructing a basis for purchaser demand.

What we’re watching: If Manhattan employees proceed their return to the workplace, Manhattan’s actual property may see elevated demand from present commuters or these seeking to stay in vibrant, city neighborhoods.

Trying Forward at 2024

As the previous couple of weeks of the autumn season fade away, the Manhattan actual property market stands at a crossroads, with varied macro and micro elements vying for affect. From rates of interest and financial indicators to world occasions and native work patterns, the market’s trajectory is formed by many components. Whereas challenges persist, we’re watching the resilience and dynamism of Manhattan actual property, which stays considered one of its defining options.