Obtain free Price of dwelling disaster updates

We’ll ship you a myFT Each day Digest e mail rounding up the newest Price of dwelling disaster information each morning.

UK renters are being squeezed by the price of dwelling disaster, with new official information displaying they’re 5 instances extra prone to battle financially than outright householders.

The possibilities of renters going through monetary vulnerability have been 4.7 instances larger than for individuals who personal their properties and not using a mortgage, in response to a study by the Workplace for Nationwide Statistics launched on Friday.

The ONS’s standards for measuring monetary vulnerability contains being unable to afford an sudden however obligatory expense of £850, borrowing greater than typical, struggling to satisfy energy payments and never with the ability to save.

David Ainslie, ONS principal analyst, stated: “At the moment’s evaluation provides to our work figuring out inequalities in society and the way sure teams have been extra affected by the elevated value of dwelling than others.”

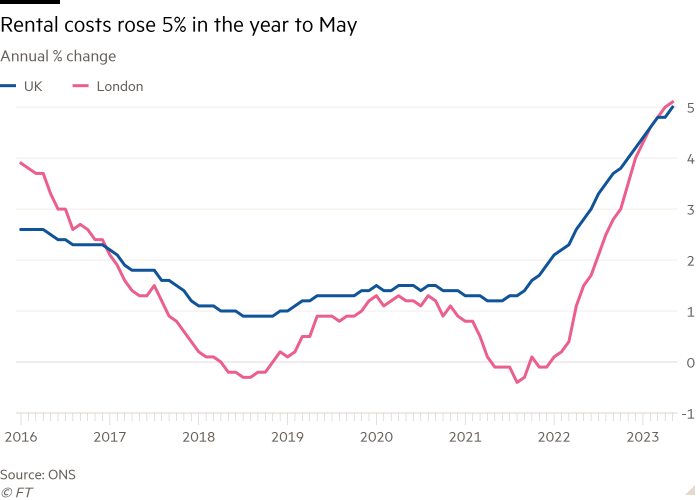

The findings come as UK rental costs rose at an annual charge of 5 per cent in Might, the quickest because the sequence started in 2016.

As many as 4 in 10 renters reported issue in assembly their lease funds, in response to the evaluation, which used information from February 8 to Might 1. This in contrast with three in 10 mortgage holders who stated they have been struggling to afford their funds.

Renters have been additionally extra probably than mortgage holders to have minimize spending on groceries and necessities, run out of meals, be behind on power funds or have a direct debit that they’re unable to pay, the research confirmed.

The ache of the price of dwelling disaster was “feeding into the housing market with mortgage charges hovering and inflicting knock-on penalties within the non-public rented sector”, stated Paul McGuckin, an analyst at unbiased consultancy Broadstone.

The raised publicity of renters’ to some type of monetary vulnerability could replicate that, on common, renters spend 21 per cent of their disposable earnings on lease, in response to the ONS. That is larger than the 16 per cent mortgage holders spend on their mortgages.

Within the two weeks to June 9, renters have been extra probably discover their funds had elevated than mortgage holders, at 42 per cent and 32 per cent, respectively, separate ONS information included in Friday’s launch confirmed.

Whereas rates of interest have been climbing because the finish of 2021, many fixed-rate mortgage debtors have thus far been insulated from these rises as their contracts haven’t but expired.

However earlier this week, the Financial institution of England calculated that 1mn households confronted mortgage cost will increase of £500 a month or extra by the top of 2026, with one other 6mn anticipating rises as much as that quantity.