FINRA is the Monetary Trade Regulatory Authority. It’s a not-for-profit group licensed by the U.S. authorities to supervise broker-dealers in the USA. They function beneath the oversight of the Securities and Trade Fee (SEC).

FINRA’s overarching targets are to guard traders and guarantee market integrity. The FINRA social media targets are the identical. A part of their function is to make sure that adverts for funding merchandise are truthful and never deceptive. In addition they oversee disclosure and recordkeeping necessities for funding merchandise.

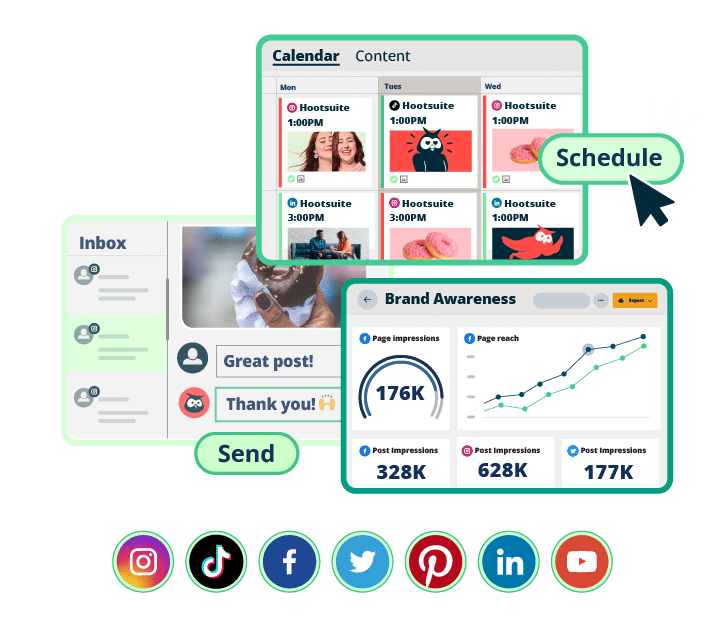

#1 Social Media Tool for Financial Services

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

FINRA first began issuing steering particular to social media way back in 2010. That’s when social networking was nonetheless in its infancy.

13 years later, FINRA has quite a bit to say about social media. That’s not stunning. Their research shows social media has turn into the highest supply of investing info for Gen Z traders. Virtually half of millennials and greater than 1 / 4 of Gen X additionally depend on social to study investing.

Supply: FINRA Investor Education Foundation and CFA Institute

FINRA guidelines apply to social media like some other communications medium. As FINRA puts it:

“Social media could also be a brand new medium, however FINRA’s guidelines on speaking with the general public are nonetheless relevant.”

All through this publish, we’ll discover what that appears like in apply for financial institutions that talk with clients by way of social media.

Listed here are a few of the most typical methods to run afoul of FINRA laws on social media.

Not archiving consumer and prospect communications

FINRA requires you to archive communications associated to “enterprise as such” for no less than three years. FINRA social media archiving is not any totally different.

This could get difficult if brokers use particular person accounts for enterprise functions. Certain, you’ve gotten archiving arrange in your company channels. However do you’ve gotten an archive of communications by way of these particular person accounts?

Needless to say the archiving necessities lengthen past direct messaging. In addition they apply to public feedback in your social channels.

Lack of acceptable supervision/approval by a principal

A registered principal should evaluation agency social media accounts earlier than use. This consists of accounts managed by particular person representatives and brokers.

All static content material on social channels should be accredited by a registered principal earlier than posting. Interactive content material should be monitored for compliance.

What’s the distinction between static and interactive communications? Static content material stays on-line for the long run. Interactive communication occurs in actual time. For instance, a social publish is static, however responding to feedback on that publish is interactive.

Extra suitability rules apply to interactive communication that recommends particular merchandise. Both:

- A registered principal should approve the advice upfront, or

- The advice should conform to an accredited template.

It’s essential to preserve data of those approvals.

Dealing with feedback posted on social channels

You’ll want to monitor feedback in your social channels. Search for complaints, directions, or some other communications that want evaluation. These feedback are topic to the identical timeframe necessities as some other communications.

You don’t must do something about feedback with constructive suggestions about your agency. That’s, except you want or reply to them or share them. In that case, you’ve gotten “adopted” the feedback. So, it’s good to present testimonial disclosures. You are able to do so by way of a clearly labeled hyperlink.

Linking to third-party web sites

Curated content is a good way to spherical out your social media content material calendar. However it’s good to watch out about what you share. Contemplate FINRA Regulatory Notice 11-39. It prohibits companies from linking to websites that include “false or deceptive content material.”

Regulatory Notice 17-18 additional clarifies:

“By sharing or linking to particular content material, the agency has adopted the content material and can be answerable for guaranteeing that, when learn in context with the statements within the originating publish, the content material complies with the identical requirements as communications created by, or on behalf of, the agency.”

Enthusiastic about sharing a hyperlink to a useful resource on a third-party website? First, do an intensive evaluation of the positioning to verify it offers solely credible info.

Working with influencers

Funding companies can work with social media influencers and referral packages. However they need to be significantly rigorous in screening influencers.

Earlier than working with an influencer, evaluation their current social content material. Examine for something that violates compliance necessities or creates reputational threat.

As soon as you identify a relationship with an influencer, it’s good to make certain they’re nicely educated. Put supervisory procedures in place. You additionally want to take care of data of their communications associated to your enterprise. That features public feedback in addition to DMs.

It is a lot extra oversight than many influencers normally get. So, they could bristle at these necessities. In the event that they’re not keen to work with you to observe FINRA pointers, they don’t seem to be match for your enterprise.

In accordance with FINRA, social media influencers’ posts and feedback have to be labeled as adverts. Regulatory Notice 17-18 states:

“Corporations ought to clearly determine as ads any communications that take the type of feedback or posts by influencers and embrace the broker-dealer’s title in addition to some other info required for compliance with Rule 2210.”

Making inappropriate claims

Social media might seem to be an informal platform for interacting with potential purchasers. However social media content material nonetheless must observe the content material requirements in FINRA Rule 2210 on Communications with the Public.

Among the FINRA rule 2210 social media expectations are:

- Social content material should be balanced and full.

- You can’t make false or exaggerated claims.

- You may’t predict or challenge efficiency.

FINRA social media violations are handled by way of an enforcement course of.

Supply: FINRA

Disciplinary motion can vary from the issuance of a Cautionary Motion all the best way as much as being barred from the brokerage business. (The latter applies solely in circumstances of great misconduct.) Different sanctions embrace fines and suspensions.

Listed here are the potential particular person sanctions for approval, evaluation, recordkeeping, and submitting violations.

Supply: FINRA Sanctions Guidelines

For companies, the identical violations can lead to fines of $5,000 to $80,000.

Supply: FINRA Sanctions Guidelines

After all, as famous above, these aren’t the one potential methods to violate FINRA laws on social media. Right here’s a real-world disciplinary instance.

In December 2022, FINRA disciplined a General Securities Representative. They fined him $5,000 and suspended him for 10 enterprise days due to a collection of posts on his public Fb Web page.

FINRA cited the textual content of a few of these posts in its choice. Right here’s one instance:

“Good afternoon all, I’m extraordinarily happy to announce Our month-to-month efficiency for September 2019 . [Hedge Fund A] took third place for an choices hedge fund with a month-to-month return of two.79%. and with that, we’re at the moment the TOP performing choices technique hedge Fund on the road. Our 2019 YTD return of 35.38% is over 100% larger than the second greatest performing choices fund as we have now beat the S&P yearly since our 2015 inception! Who has your greatest pursuits in thoughts,? WE DO!”

FINRA discovered that the consultant violated three FINRA Guidelines as a result of the posts:

- Made claims about efficiency with out sufficient info to judge the claims;

- Had been typically options-related however didn’t have the suitable disclosures; and

- Weren’t reviewed by a agency principal or submitted to FINRA’s Promoting Regulation Division.

It’d all sound overwhelming. However when you’ve got the correct procedures in place, you possibly can assist preserve your organization consistent with the FINRA guidelines on social media.

1. Perceive the laws

As you’ve seen, fairly a number of FINRA guidelines and laws apply to social media channels.

The principle matters you want to concentrate on when planning your social media technique are:

- Recordkeeping and submitting necessities

- Approval, supervision, and evaluation necessities

- Communications guidelines

- Guidelines associated to testimonials, influencers, and social adverts

- Guidelines associated to adoption of/linking to third-party content material

We lined the highlights earlier on this publish. For an in-depth understanding of FINRA laws on social media, examine Regulatory Notice 17-18.

2. Prepare your workforce

One of the crucial vital issues to your workforce to know is the distinction between enterprise and private use of social media. Regulatory Notice 11-39 particularly notes:

“A agency’s insurance policies and procedures should embrace coaching and schooling of its related individuals concerning the variations between enterprise and nonbusiness communications and the measures required to make sure that any enterprise communication made by related individuals is retained, retrievable and supervised.”

The Sanctions Guidelines additionally determine “ample coaching and academic initiatives” as a principal consideration when figuring out cope with a violation.

Common coaching on FINRA social media compliance and the newest developments on social media for financial services helps defend your model.

3. Restrict entry to your social accounts

Inappropriate entry to your social accounts opens your agency as much as many FINRA social media violations. These would possibly embrace lack of supervision, deceptive statements, or buyer information breaches. There’s loads at stake inside every social account.

It’s not a greatest apply for workforce members to log into social platforms instantly. As an alternative, use a social media administration software like Hootsuite to handle entry and permissions inside your accounts. This provides every workforce member the suitable stage of entry for his or her function. It additionally means that you can arrange an approval workflow. This ensures all social posts can get principal evaluation earlier than posting.

4. Create clear social media pointers

Social media guidelines are an vital doc for any model. For monetary providers manufacturers, they’re crucial.

As for all manufacturers, your social media pointers ought to embrace:

- Disclosure and transparency necessities;

- Privateness guidelines;

- Cyber security pointers;

- Pointers on harassment and inclusivity; and

- Copyright and trademark pointers.

Corporations topic to FINRA laws must take issues a step additional. Add particular procedures for supervision, approval, and archiving.

Having a FINRA social media coverage in place is a principal consideration within the Sanctions Guidelines.

Bonus: Get a free, customizable social media policy template designed specifically for banks to quickly and easily create guidelines for your financial institution.

5. Create a content library

Once your content is approved, add it to a content library. This gives your team a growing catalog of resources to use without the extensive approval requirements for new content. For example, the Suitability Rules say companies ought to:

“Prohibit interactive digital communications that suggest particular merchandise except:

- a registered principal has beforehand accredited the content material, or

- the advice conforms to a beforehand accredited template.”

Along with a content material library, you should utilize Hootsuite Amplify to make newly accredited content material obtainable to all workforce members. That is particularly helpful for impartial brokers, brokers, and advisors.

6. Examine content material for compliance earlier than publishing

Each social publish must undergo a compliance evaluation earlier than posting. However compliance consultants shouldn’t waste their time addressing repetitive primary compliance points.

Coaching helps scale back compliance points earlier than content material enters the approval workflow. One other technique to scale back compliance revisions is to make use of an automatic compliance software like ProofPoint.

Hootsuite’s ProofPoint integration routinely blocks content material for compliance requirements violations. It flags particular objects that want revision. Your social workforce can then make the adjustments earlier than sending the publish to the compliance workforce for evaluation. This frees up your compliance consultants to handle extra complicated compliance necessities. It additionally reduces the quantity of forwards and backwards required for every publish.

7. Preserve impeccable archives and data

Right here’s hoping you by no means need to undergo a regulatory audit. However in case you do, you’ll want data and archives of all of your social media exercise and communications.

Hootsuite integrates with options like Brolly to routinely archive posts, feedback, and different communications. All the things goes right into a searchable archive with the whole context.

Hootsuite additionally data your approval signoffs. You’ll have a full report of the approvals required by FINRA.

Hootsuite makes social advertising and marketing simple for monetary service professionals. From a single dashboard, you possibly can handle all of your networks, drive income, present customer support, mitigate threat, and keep compliant. See how the software can work for your enterprise.

Get extra leads, have interaction clients and keep compliant with Hootsuite, the #1 social media software for monetary providers.

![3 Tools to Use Instead of Facebook Analytics [2024 Edition]](https://18to10k.com/wp-content/uploads/2023/11/Facebook-analytics-350x250.png)