Insurance coverage social media advertising and marketing presents distinctive challenges. Potential clients can’t simply click on a button to purchase — as a substitute, they full an software and qualification course of to get a quote.

Shoppers are sometimes price-sensitive. They know they want insurance coverage. However they might not perceive why it’s so essential or how insurance policies differ. Social media advertising and marketing for insurance coverage corporations affords the flexibility to deal with these issues.

Lastly, insurance coverage manufacturers additionally must adjust to industry-specific rules that outline what can and might’t be mentioned on social media (and throughout different digital advertising and marketing channels).

Preserve studying to learn how to construct an efficient and compliant technique, and set your model aside from the competitors on social media.

Bonus: Download our free, customizable social media calendar template to easily plan and schedule all your content in advance.

Building awareness

Social tools reach people where they already spend time online. So they offer a valuable opportunity to increase brand awareness.

Developing a strong brand voice is key to becoming recognizable on social channels. In turn, you stay front of mind when people think about buying a new policy.

Consider how Progressive Insurance uses Twitter. Rather than a brand account, they have an account for their well-known spokeswoman, Flo.

The account posts almost no content about Progressive’s policies. But it does keep Progressive on the radar of 68,000 followers. Content ranges from tips to consider when buying a new home to simple positive thoughts.

Check the smoke detectors in your new house. ‘Cause falling asleep with a pizza in the oven happens fr … 🫢 pic.twitter.com/cIWmLqGK1G

— Flo from Progressive (@ItsFlo) April 24, 2023

Cleaned the 🏠 and crammed the closet. Hey, a win’s a win. What’s yours? pic.twitter.com/NxzsTAtWfX

— Flo from Progressive (@ItsFlo) April 27, 2023

Enhancing belief and credibility

Belief in private and property/casualty insurance coverage increased in 2022.

Supply: Edelman Trust Barometer

That mentioned, belief for property/casualty insurance coverage remains to be beneath 50% for many of the G7 nations. It hasn’t risen above impartial in these nations for private insurance coverage, both. Insurance coverage corporations have work to do with regards to rising shopper belief.

Social media gives two-way communication. And it’s an incredible car for behind-the scenes content material. These are each alternatives to humanize your model. You’ll be able to present that your workforce is made up of actual individuals who have your purchasers’ finest pursuits at coronary heart.

Customer support

Social customer service is now not optionally available for insurance coverage manufacturers. Your purchasers – and potential purchasers – anticipate finding you on the channels they use on a regular basis. Channels like Messenger and WhatsApp have turn into important for assist. You’ll be able to’t ignore buyer inquiries and issues that come by these platforms. Doing so could be sufficient to lose a shopper or earn a destructive overview.

Conversely, a useful reply that makes your buyer’s life simpler can earn ongoing loyalty at renewal time.

We may help you with this over right here, Laura. Are you able to please ship us a personal message along with your coverage quantity on the hyperlink beneath? https://t.co/r9HpFiEUiH

— Churchill (@Churchill) May 1, 2023

There are a few essential benefits to providing customer support by social channels.

First, it’s simple to attach a chatbot to deal with easy or ceaselessly requested questions. AI is improving and chatbots are getting more sophisticated. They’re studying to reply extra of your purchasers’ questions. They will present 24-hour service to get issues began in case of a late-night declare.

You may also connect your social channels to your CRM. This provides brokers a full file of all buyer contact. With all accessible information, they will finest assess a shopper’s coverage wants.

Reduce response time (and your workload)

Manage all your messages stress-free with easy routing, saved replies, and friendly chatbots. Try Hootsuite’s Inbox today.

Social listening

Social listening is a technique of monitoring related key phrases and hashtags on social channels. This provides you a way of what’s occurring in your {industry} and what persons are saying about you on-line.

It gives the chance to catch destructive suggestions earlier than it gets out of control. Or to answer pertinent on-line conversations even if you’re not tagged.

Social listening may give insights into potential new merchandise.

For instance, Meta Foresight found that pet insurance coverage was a trending matter of dialog associated to pet possession. Greater than 80,000 posts use the #petinsurance hashtag on Instagram and one other 63,000 on Fb.

Hootsuite Streams gives an automatic technique to carry on high of social conversations. You’ll be able to even use Twitter’s advanced search functions proper in your Hootsuite dashboard.

Lead era

Insurance coverage is mostly not an impulse purchase. As a substitute, you want to generate and nurture leads. Social media advertising and marketing for insurance coverage brokers feeds your gross sales funnel.

Constructing a social media presence is the most effective tactic for enhancing lead high quality. Amongst social platforms, Fb is the most effective web site for B2B lead era.

Lead era is a giant topic, so we’ve received a whole blog post to stroll you thru the main points.

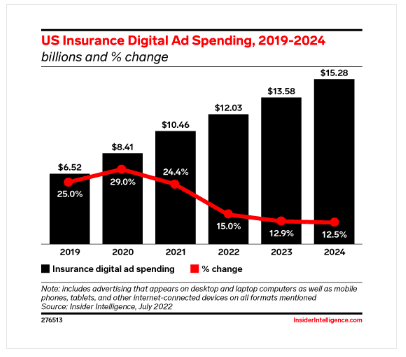

Promoting

eMarketer predicts U.S. insurance coverage corporations’ digital advert spend will improve to $13.58 billion in 2023. That’s up from $12.03 billion in 2022. Whereas the precise quantity spent on digital advertisements is rising, the speed of development is slowing. The insurance coverage share of the digital promoting pie can also be shrinking. It went right down to 4.8% in 2023 from 5.5% in 2020.

Supply: eMarketer

Nonetheless, the numbers recommend your opponents are utilizing social ads. Should you’re not profiting from paid social to succeed in new audiences, chances are you’ll be dropping out.

Fb

Fb affords an attention-grabbing alternative for insurance coverage manufacturers. It’s a spot the place folks go to attach with family and friends. In different phrases, it’s a social media platform on which individuals talk with their most trusted contacts. So it could be no shock that persons are 5 times as prone to uncover or consider auto insurance coverage on Fb as on quote aggregators.

Facebook Groups present one other attention-grabbing alternative. Particularly for insurers providing specialist protection to attach with area of interest communities. Possibly it’s classic guitar collectors. Or high-end gaming methods aficionados. These folks want insurance coverage past the usual coverage choices. Connecting in a bunch is a simple technique to keep front-of-mind and lift consciousness in regards to the limits of an ordinary coverage.

Lastly, Fb Messenger has turn into a channel by which individuals anticipate customer support. Folks and companies already change 20 billion messages on Messenger each month.

Instagram is the top platform for constructing relationships with manufacturers. It affords the possibility to be a little bit extra pleasant and human in your social media. Reels and Tales are the appropriate sort of content material to showcase behind-the-scenes insights into your organization and spotlight your company tradition.

Instagram can also be a great channel for leaping on social media traits. You might experiment with memes – if that’s acceptable in your brand voice.

And don’t neglect to examine your DMs. As soon as once more, clients will attain out on the platforms they already use. A fast response good points loyalty and belief, whereas silence breeds contempt.

Having hassle maintaining with messages coming in by totally different channels? Strive utilizing a software like Hootsuite Inbox to handle all of your social messaging in a single place.

LinkedIn is the place to attach with company, industrial, and business purchasers. That applies for each insurance coverage corporations and particular person brokers

It’s an incredible place for firm executives, brokers, and brokers to share thought management. This will develop their reputations as {industry} leaders.

Folks announce skilled life modifications like huge strikes and new jobs on LinkedIn. This gives the possibility for advisors to succeed in out with messages of congratulations. And to offer a pleasant reminder that life modifications can result in coverage modifications too.

Thought 1: Model-approved and compliant posts for insurance coverage brokers

Compliance is a key concern when utilizing social media within the insurance coverage {industry}. Relying in your location, the best way you may (and might’t) use social media could be outlined by industry-specific regulatory our bodies like:

A great way to remain compliant — and keep away from violations and charges — is creating accredited content material on the company stage. You’ll be able to then determine whether or not to permit particular person brokers to customise their very own insurance coverage social media posts or not.

PPI is a Canadian nationwide insurance coverage advertising and marketing group. It gives assets for impartial brokers. A type of assets is The Hyperlink Between. It’s an academic portal from which brokers can share accredited content material.

Undecided how you can handle customizable social media content material for insurance coverage brokers? Hootsuite Amplify is an advocacy program that permits you to create content material that’s pre-approved and able to share on social.

Hootsuite integrates with Proofpoint, so even in the event you do enable particular person brokers or workforce members to customise accredited content material, you may relaxation assured that they received’t violate {industry} rules. If a consumer tries to publish a put up containing language that goes in opposition to {industry} guidelines, an administrator might be notified, and the put up might be routinely routed for handbook approval.

To-do checklist:

- Begin constructing a again catalog of evergreen content material for advisors to share.

- Arrange a system for sharing accredited insurance coverage social media posts.

- Create incentives for advisors to participate.

Thought 2: Share infographics, academic movies or carousels

The choices for academic content material associated to insurance coverage are huge. First, you would educate customers about insurance coverage itself. What do sure phrases imply? What is mostly lined in an ordinary coverage?

You may also educate followers about subjects associated to the areas you insure. This will in flip scale back the variety of claims. Should you supply medical insurance, supply suggestions for wholesome dwelling. Should you supply dwelling insurance coverage, discuss methods to stop flood or hearth.

To-do checklist:

- Brainstorm academic concepts. Keep related to your model, your followers, and the protection you present.

- Type content material concepts into infographics, video content material, and carousels. Some subjects may work in every format on totally different social platforms.

Thought 3: FAQs along with your in-house consultants

This expands on the thought of academic content material. But it surely goes a step additional by displaying off the experience of your folks. You might speak to:

- advisors

- adjusters

- restoration consultants

- mechanics

- or every other skilled related along with your workforce.

Strive creating an ongoing social video collection. Or use a constant graphic remedy so your FAQs are simply recognizable. Let your followers get to know the consultants behind your model. They’ll really feel comfy that they’re being taken care of by the most effective within the enterprise.

To-do checklist:

- Compile a listing of ceaselessly requested questions related to the sorts of insurance coverage you supply or the areas for which you present protection.

- Take into consideration who inside your group could be a great consultant skilled for every space of data.

- Plan your video collection.

- Schedule this high-value content material for the instances when your audience is most likely to be online.

Thought 4: Testimonials or case research

We talked about earlier that belief in insurance coverage companies, whereas enhancing, shouldn’t be presently nice in most G7 nations. Social proof is a wonderful technique to overcome shopper doubts about your model.

Social media contests could be an efficient technique to collect shopper testimonials:

The tone of the testimonials or case research must align along with your model voice. Take into account the instance from BCAA above. Then examine it to this overview compilation by the Gen-Z-centric insurance coverage model Lemonade:

To-do checklist:

- Take into consideration the most effective methods to collect buyer suggestions. Test overview websites. Search your e mail for glowing thanks. Attain out to clients with whom you’ve got a long-term relationship. Bear in mind to solely use testimonials with permission.

- Brainstorm concepts to encourage purchasers to share testimonials, like a contest or branded hashtag.

Thought 5: Spotlight company giving or worker volunteerism

Exhibiting your workforce doing good work can do quite a bit in your model’s fame. It may be particularly significant to volunteer or donate in areas associated to your coverage choices. However don’t let that restrict you.

Any actions your workforce undertakes to profit the group assist construct model belief. An insurance coverage coverage is a major buy. Shoppers need to know they’re coping with a model whose values align with their very own.

To-do checklist:

- Evaluate your company giving and group service applications to make sure there are alternatives in your workforce to offer again.

- If you and your workforce do one thing nice, shout it from the rooftops. Create content material to share your efforts.

- Take into consideration methods to get purchasers concerned for a fair larger sense of group.

Thought 6: Influencer partnerships

U.S. adults who analysis medical insurance choices on social media search for opinions from folks like themselves. According to Forrester Research, 43% learn social media posts from consultants. Nearly as many – 40% – search for opinions from friends.

The identical report discovered that solely 30% use insurers’ pages to analysis which insurance policies to purchase. Are you limiting your social advertising and marketing efforts to your owned social channels? You’re lacking out on the 70% who look elsewhere to analysis their insurance coverage wants.

An influencer partnership gives the possibility to succeed in a brand new viewers by an already trusted voice.

To-do checklist:

- Begin researching potential influencers related to your target market.

- Attain out to debate potential partnerships and content material methods.

- Be taught in regards to the compliance necessities associated to disclosure and branded content material.

Develop your shopper base with the software that makes it simple to promote, interact your viewers, measure efficiency, and win on social media — all whereas staying compliant.

E book a personalised, no-pressure demo to see how Hootsuite helps monetary companies:

→ Drive income

→ Show ROI

→ Handle threat and stay compliant

→ Simplify social media advertising and marketing

![2023 Guide to Insurance Social Media Marketing [6 Tried Tactics]](https://18to10k.com/wp-content/uploads/2023/05/Insurance-social-media-750x750.png)

![3 Tools to Use Instead of Facebook Analytics [2024 Edition]](https://18to10k.com/wp-content/uploads/2023/11/Facebook-analytics-350x250.png)