Obtain free Residential property updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest Residential property information each morning.

Residential rental prices elevated on the quickest annual charge since information started seven years in the past, whereas UK home worth rises slowed to the bottom charge in a decade, in response to official information revealed on Wednesday.

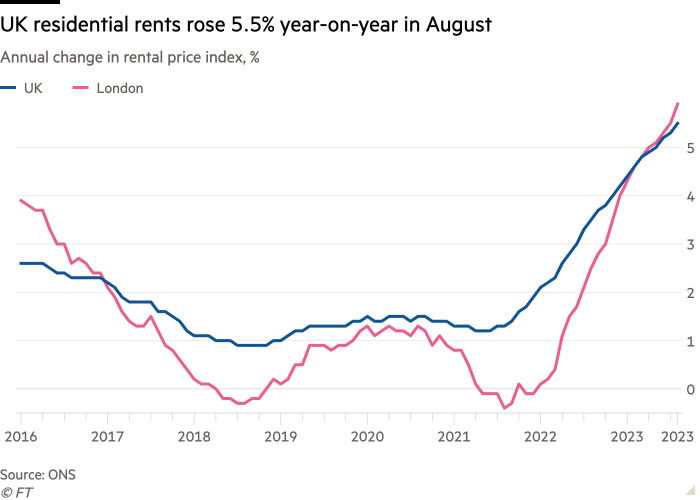

Personal rents rose 5.5 per cent 12 months on 12 months in August, up barely from 5.3 per cent in July, and the biggest annual proportion enhance for the reason that Workplace for Nationwide Statistics information sequence started in January 2016.

In the meantime, the annual development in home costs dropped to 0.6 per cent in July, down from 1.9 per cent in June, to the slowest charge since September 2012, in response to separate ONS information.

The traits in rental and home costs mirror the surge in mortgage charges over the previous two years, which have made shopping for a property unaffordable for a lot of, boosting demand for lettings in a constrained market, the place landlords are additionally passing on their elevated borrowing prices.

Emma Humphreys, Associate on the legislation agency Charles Russell Speechlys, stated: “There are tenants struggling to pay their hire, and lots of landlords are being squeezed simply as tightly, with rising mortgage funds and adjustments to tax reliefs forcing many to let go of their properties.”

Though lenders have began decreasing mortgage rates in current months, they’re nonetheless near 15-year highs, reflecting successive charge rises by the Financial institution of England from a file low of 0.1 per cent in November 2021 to five.25 per cent.

The ONS information confirmed that rents in August rose on the quickest charge in Wales at 6.5 per cent, adopted by Scotland at 6 per cent, whereas in England the common was 5.4 per cent. The information for Northern Eire is for June, which confirmed a 9.1 per cent rise.

London’s annual rental worth development, at 5.9 per cent, was the best of all English areas and at its highest annual charge for the reason that information sequence started in January 2006.

The capital was additionally one of many outliers in home worth traits, registering a 0.8 per cent year-on-year drop in July, though the south west of England noticed an even bigger fall of 1 per cent.

The common UK home worth in July was £290,000, down £2,000 from the height in November final 12 months however nonetheless £59,200 larger than February 2020, the final month earlier than the coronavirus pandemic hit.

Gabriella Dickens, economist at Pantheon Macroeconomics stated, more moderen information from Nationwide and Halifax, which confirmed home costs falling on the quickest annual charge since 2009 in August, meant that “additional declines within the official index over the approaching months look possible”.