Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

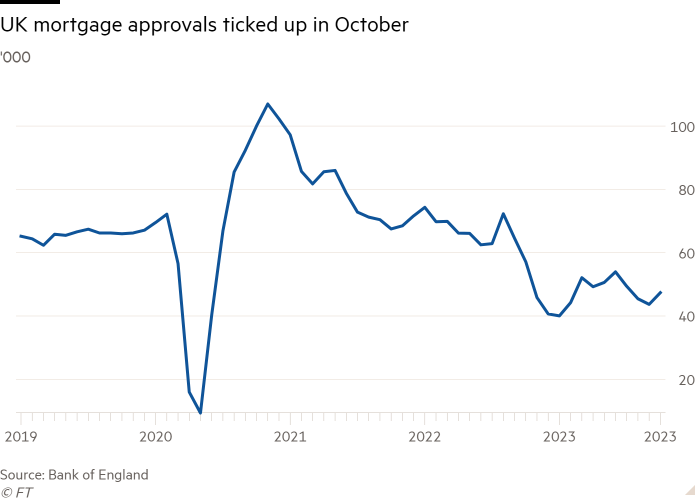

UK mortgage approvals rose greater than anticipated in October, based on official figures revealed on Wednesday that time to a stabilisation within the property market after a protracted interval of low home gross sales.

Web mortgage approvals for home purchases rose to 47,400 in October from 43,700 in September, Financial institution of England information confirmed. The quantity was properly above economists’ expectations of 45,000 and the very best since July, however about 28 per cent under its stage in October 2019, earlier than the pandemic.

Web approvals for remortgaging elevated to 23,700 from 20,600 in the identical interval.

Mortgage approvals present a well timed measure of the well being of the housing market, which impacts the broader financial system by way of house-related spending and family confidence.

The info launched on Wednesday suggests an easing within the housing downturn, after a fall in the price of some standard mortgage merchandise following the BoE’s resolution to leave interest rates at 5.25 per cent in September and November.

Jason Tebb, chief government of property search web site OnTheMarket.com, mentioned it was “clear that the pause in rate of interest hikes has boosted market stability and purchaser confidence”.

Two-year mounted mortgage charges with 60 per cent loan-to-value eased from 6.2 per cent in July to five.5 per cent in October, the BoE mentioned, whereas charges on standard five-year offers have additionally declined for the reason that summer time.

Final month, mortgage suppliers Halifax and Nationwide reported a month-on-month rise in home costs in October, though the typical property was cheaper than in the identical month in 2022.

Nonetheless, final month all standard mortgage merchandise remained between two and 5 instances greater than costly than in 2021. In the meantime, the typical fee on new mortgages rose to a 15-year excessive of 5.25 per cent in October, leaving home gross sales properly under their pre-Covid common.

The BoE information additionally confirmed that shopper credit score eased solely barely to £1.3bn final month from £1.4bn in September. The determine has remained largely steady over the previous two years, though a very low quantity in October 2022 pushed the annual comparability to the very best since 2018.

Paul Dales, chief UK economist on the consultancy Capital Economics, mentioned resilient shopper credit score information advised that “greater rates of interest are but to considerably crimp unsecured borrowing”. Nevertheless, its energy may be a results of households being compelled to borrow to fund spending, he added.

Customers additionally saved extra final month, which may negatively have an effect on spending and financial development. Households deposited £4.6bn in banks and constructing societies, based on the BoE, the very best since November final yr. The rise was pushed by flows into fixed-term accounts, which normally pay extra curiosity than immediate entry accounts.

Samuel Tombs, economist on the consultancy Pantheon Macroeconomics, mentioned he anticipated spending to rise quickly as financial savings stabilised.

“Households’ saving fee . . . won’t enhance additional, enabling the restoration in actual disposable earnings to feed by to spending,” he mentioned.