Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

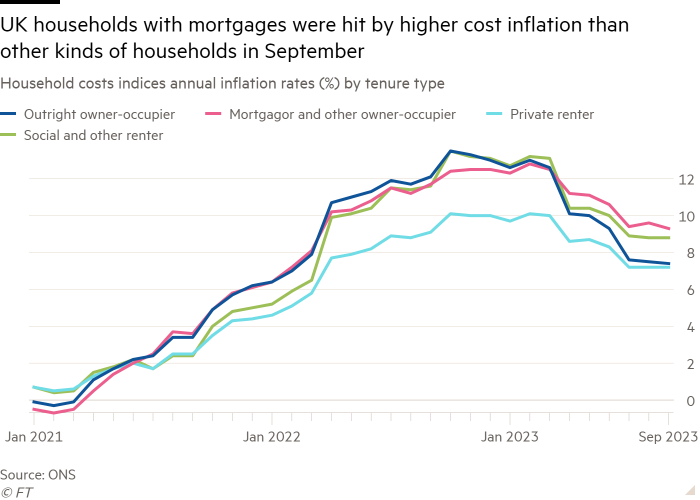

UK households with mortgages had been hit by greater inflation than some other family kind in September primarily due to rising borrowing prices, in line with official information that lays naked the uneven influence of the price of dwelling disaster.

Family value inflation for these with mortgages was 9.3 per cent within the 12 months to September, the Workplace for Nationwide Statistics stated on Monday, the very best of any socio-economic group.

That compares with a headline value inflation price of 8.2 per cent, and client value inflation of 6.7 per cent in the identical interval.

For personal renters, the price inflation price was 7.2 per cent within the 12 months to September. It was 7.4 per cent for many who owned their property outright.

The ONS stated the larger hit to mortgaged households was primarily due to excessive curiosity funds, which elevated because the Financial institution of England raised the price of borrowing to a 15-year excessive of 5.25 per cent over the previous two years.

The info was a part of the primary quarterly publication of the ONS family value index, which relies on how a lot several types of households spend on items and companies.

The headline inflation price, in contrast, displays value development of products and companies consumed by all UK households.

Because of this, meals and vitality value development, for instance, have a larger influence on the skilled inflation of poorer households as a result of they spend an even bigger share of their earnings on necessities.

The ONS HCI additionally consists of the prices confronted by households from adjustments in mortgage rates of interest, stamp obligation and different prices associated to the acquisition of a dwelling, which aren’t included within the headline inflation price.

The statistics company subsequently judges that the measure “most intently displays households’ lived expertise”.

Along with surpassing client value inflation in September, family value inflation peaked at a price of 12.6 per cent in October final 12 months, in contrast with the 41-year excessive CPI of 11.1 per cent.

Nevertheless, the company stated mortgagors additionally spent greater than different teams on eating places and inns, the place costs have elevated rapidly in latest months, contributing 1 proportion level to total inflation for them.

In contrast, renters spent extra on electrical energy and different fuels. Annual value development in that class has plunged on the again of a normalisation after the vitality shock sparked by Russia’s full-scale invasion of Ukraine.

Rental prices are rising at their quickest tempo in at the very least seven years, contributing 1.6 proportion factors to the annual inflation skilled by tenants.

The distinction between renters and other people with mortgages is more likely to widen within the coming months after electrical energy and fuel value development turned detrimental in October, whereas extra households had been compelled to remortgage at greater charges.

Paul Dales, economist on the consultancy Capital Economics, stated quicker development within the HCI for mortgagors was “precisely what you’d count on and what the BoE would wish to see after elevating rates of interest”.

Increased borrowing prices diminished demand within the financial system by squeezing the actual incomes of these with money owed relative to these with out, he added.

The ONS information additionally confirmed that the big distinction in inflation skilled by poorer and richer households all through 2022 almost disappeared in September 2023, reflecting diverging traits in vitality and mortgage prices.

In October 2022, annual inflation for low-income households peaked at 13.5 per cent, pushed by excessive spending on vitality.

In the identical interval, high-income households had been hit by a price of 11.5 per cent, 2 proportion factors much less, the biggest hole between the 2 teams in 13 years.

Dr Sarah Cumbers, chief govt of the Royal Statistical Society, stated the skilled physique had “lengthy been campaigning for the event of the family value indices as one of the simplest ways to” signify the influence of inflation.

“We hope the federal government takes be aware of at present’s figures which present that inflation is greater, and hitting these with a mortgage and social renters the toughest,” she added.

The federal government stated: “Inflation has halved, however we all know some persons are persevering with to wrestle, which is why we’re dedicated to staying the course and getting all of it approach again right down to 2 per cent.”

It added that it was serving to households “by offering £3,700 on common in value of dwelling help” and thru its mortgage constitution.

![Mobidea Facts & Figures [Updated 2026 ]](https://18to10k.com/wp-content/uploads/2026/01/Mobidea-Facts-and-Figures-120x86.png)