Obtain free UK property updates

We’ll ship you a myFT Each day Digest electronic mail rounding up the most recent UK property information each morning.

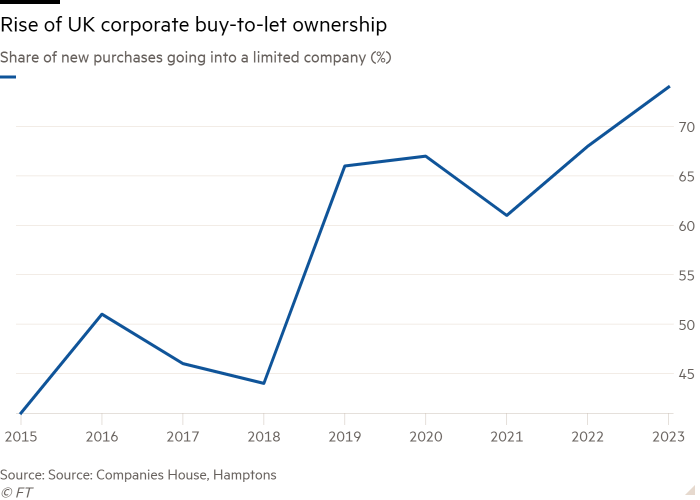

Almost three quarters of buy-to-let properties bought this 12 months have been purchased by restricted corporations, exhibiting landlords’ choice for the tax benefits of company possession as borrowing prices soar.

Landlords can select to personal a buy-to-let property in their very own identify or through an organization construction. Some 74 per cent of buy-to-let purchases in England and Wales have gone down the company route to date in 2023, up from 68 per cent final 12 months and 41 per cent in 2015, in response to analysis by property company Hamptons.

The shift has been underneath method since full tax reduction on mortgage curiosity for buy-to-let homeowners who personal of their names was phased out between 2017 to 2020, and has accelerated with Financial institution of England rate of interest will increase.

Earlier than 2017, landlords may deduct mortgage curiosity prices from their rental earnings when calculating earnings and declare reduction at their private price of earnings tax. Because the adjustments, claims are restricted to the 20 per cent primary price, leaving landlords who pay the upper or further price going through increased prices. Mortgage curiosity deductibility continues to be out there to restricted firm homeowners, nevertheless.

The pattern picked up after charges on landlord mortgages jumped this 12 months in response to increased inflation. In December 2021, common charges on two-year buy-to-let mortgages have been 2.9 per cent. Immediately, they’re 6.6 per cent, in response to knowledge supplier Moneyfacts.

“The push to include began six years in the past and the rise in rates of interest has simply exacerbated this. It’s turn into an much more urgent situation,” stated Sean Randall, a accomplice at tax adviser Blick Rothenberg.

Although charges stay excessive, some competitors is returning to the mortgage market. Many lenders are trimming their charges, because the outlook for UK inflation — and banks’ prices of funding — has improved. The Mortgage Works, the buy-to-let arm of Nationwide, this week introduced it was chopping charges by as much as 0.5 share factors. TSB and NatWest additionally dropped charges on their buy-to-let ranges.

Having the ability to entry extra engaging rental cowl ratios is one other issue within the progress of restricted firm landlords.

When judging the viability of a mortgage, lenders look to make sure the rental earnings covers mortgage funds with room to spare. Chris Sykes, marketing consultant at dealer Personal Finance, stated the usual protection was 145 per cent of the mortgage price, “whereas it’s 125 per cent for properties held inside a restricted firm, providing the potential to borrow extra”.

Nevertheless, he added that the charges charged on restricted firm debtors have been usually increased than these supplied to particular person homeowners.

BM Options, the buy-to-let arm of Lloyds Banking Group, this week stated it could enable “high slicing” if debtors have been falling wanting qualifying for a mortgage. This implies they may embody not simply rental earnings, however a share of their earned earnings, to satisfy rental protection necessities.

Hamptons discovered that solely 22 per cent of excellent buy-to-let mortgages — the portion of the general inventory — have been company-held. Three years in the past, although, that determine was simply 15 per cent.

Switching possession to an organization construction usually incurs transaction prices: a landlord can pay stamp obligation land tax in England and Northern Eire (or an analogous transaction tax in Scotland and Wales) and should face a capital positive factors tax invoice when promoting to the company automobile.

Aneisha Beveridge, analysis director at Hamptons, stated the share of recent buy-to-let purchases going into an organization was prone to be near its ceiling. “There’ll at all times be some traders for whom proudly owning houses in their very own identify will take advantage of sense,” she stated. “The minority with out a mortgage or lower-rate taxpayers will proceed to prop up the variety of houses held in private names.”

The evaluation additionally checked out regional variations, discovering that rental properties within the north of England have been most probably to be owned by a restricted firm. This mirrored increased rental yields within the area, Beveridge stated, an element that appealed significantly to larger-scale portfolio landlords.

“Curiously, 1 / 4 of all restricted firm buy-to-lets positioned within the north-east are owned by London-based restricted corporations,” she stated.