At ABS East, an enormous gathering for the securitisation markets in Miami final month, each the temper and the climate have been higher than anticipated, attendees mentioned. However within the beleaguered subsector of mortgage-backed securities (MBS), seeing only a glimmer of sunshine is about nearly as good as it’s got this 12 months. And the forecast appears unlikely to enhance any time quickly.

With $12.2tn-worth of bonds excellent, the US MBS market ranks second in measurement solely to that for US Treasuries — which is heading in the right direction for an unprecedented third 12 months of losses as rates of interest have risen, forcing costs down, with the intention to ship the aggressive yields that buyers require.

Provided that they comprise bundles of house loans, mortgage-backed securities transfer to roughly the identical macroeconomic impulses as Treasuries. Nonetheless, their efficiency and outlook have been additional harm by massive cuts in each their provide and demand.

On prime of that, market members should issue within the travails of the US housing market, as householders battle with rates of interest that appear set to remain greater for longer than many analysts anticipated.

$12.2tnWorth of mortgage backed securities excellent

Nonetheless, on the ABS East occasion in Florida, “the sentiment . . . was encouraging, and the cheapness [of MBS] was unanimous throughout all our assembly discussions”, noticed strategists from Financial institution of America. They described the temper for MBS as certainly one of “cautious optimism”.

However there stay loads of the explanation why buyers could want to lean extra in the direction of warning.

Greater than a 12 months in the past, one of many three massive consumers of MBS — the US Federal Reserve — started a sluggish however regular withdrawal from the market, and it reveals no signal of adjusting course. This 12 months, curiosity from one other equally vital set of consumers — financial institution treasuries with extra deposits to take a position — additionally declined as buyer inflows stopped and, in some circumstances, fell.

That has left one massive group of consumers — institutional buyers and cash managers — alone in supporting the MBS market.

“The market is affordable, however it’s been low cost all 12 months and it’s stayed there,” says Ken Shinoda, portfolio supervisor at DoubleLine. “When would possibly consumers step again in? [When] both banks cease shedding deposits and want to take a position, or buyers assume the Fed’s about to chop charges they usually wish to lock in yields out the curve.

“If cash comes again in and there may be demand — whether or not it’s [from] banks, institutional buyers or cash managers seeing bond fund inflows — that would assist to drive spreads tighter.”

Spreads are the premium over US Treasury yields that buyers require to justify holding MBS, they usually have risen sharply up to now two years. At the moment, for top-rated MBS backed by the US authorities, they stand at nearly 1.8 share factors, based on Bloomberg information. That’s under a peak of 1.9 share factors in Could, however properly up from 0.6 share factors in January 2022.

For these spreads to fall, MBS costs must rise extra quickly than Treasury costs — which might then encourage contemporary funding.

1.8 pptsMBS unfold in share factors — the premium over US Treasury yields that buyers require to justify holding them

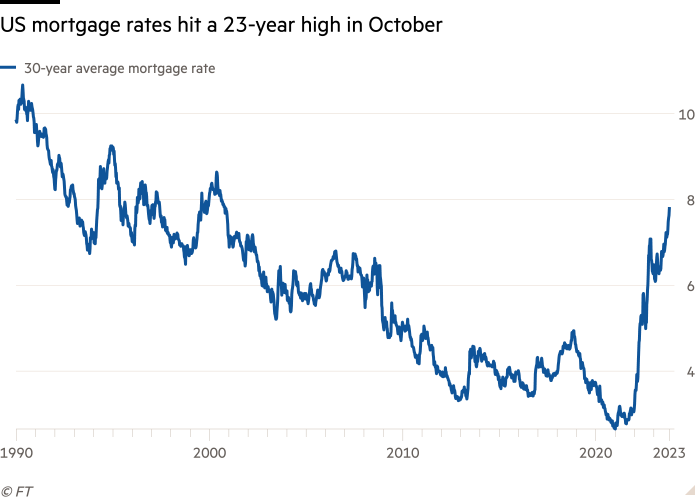

Provide, at the least, is prone to stay comparatively tight, providing some assist to MBS costs. That’s as a result of the circulate of latest house loans to again new MBS issuance has all however dried up as American householders blanch at mortgage rates approaching 8 per cent — the best stage in at the least twenty years.

Not like homebuyers in most different nations, together with the UK, consumers within the US are likely to take out 30-year fixed-rate loans — which implies they’re sometimes eager to purchase houses or to refinance, thereby creating new mortgages, when rates of interest fall.

Nonetheless, with roughly three-quarters of householders at the moment paying charges of 4 per cent or much less on their house loans, few are ready to provide these up and transfer. This reduces the inventory of homes on the market, and the variety of mortgage purposes.

Kirill Krylov, MBS portfolio strategist at funding financial institution Baird, says this has helped create “an ideal recipe for a lukewarm manufacturing of latest mortgage-backed securities”. He provides: “We’re additionally coming into winter months — a seasonal low level in house purchases, since fewer potential consumers are eager about transferring throughout a faculty 12 months.”

Krylov estimates internet MBS issuance will attain about $238bn this 12 months — the second lowest studying in eight years and a far cry from the $852bn of internet new provide in 2021, earlier than rates of interest started to rise.

“The US additionally ‘borrowed ahead’ a lot housing demand in the course of the pandemic when mortgage charges fell, and that’s additionally miserable urge for food now,” he explains.

In accordance with Citigroup analysts, the affordability hole — a measure of the distinction between precise home costs and what calculations counsel consumers can afford — is close to its widest stage ever.

“Dwelling costs must fall about 33 per cent to revive the equilibrium,” says James DeSorbo, an analyst at Citigroup, who notes that this was final seen in early 2022. “Alternatively, mortgage charges must rally [fall] again to three.5 per cent.”

Tellingly, the MBS market obtained little or no consideration in Florida final month, regardless of its measurement. Convention attendees have been far keener to debate hotter subjects, such because the position personal credit score would possibly play in different asset-backed markets. Till one thing shifts within the housing market, any response past very cautious optimism will most likely be exhausting to come back by.