Obtain free UK mortgage charges updates

We’ll ship you a myFT Day by day Digest electronic mail rounding up the newest UK mortgage charges information each morning.

4 giant UK lenders are chopping mortgage charges for the second time in three weeks, as competitors within the residence mortgage market intensifies on the again of higher than anticipated inflation knowledge.

Nationwide, the second-largest mortgage lender, on Wednesday lowered costs on some mounted merchandise by as much as 0.55 proportion factors. HSBC, the sixth-biggest supplier, trimmed prices by as a lot 0.2 proportion factors, whereas tenth-placed TSB lowered charges by as much as 0.4 proportion factors.

Halifax, a part of Lloyds Banking Group — the most important mortgage supplier within the UK — can also be chopping costs on mounted mortgages by as a lot as 0.71 proportion factors from Friday.

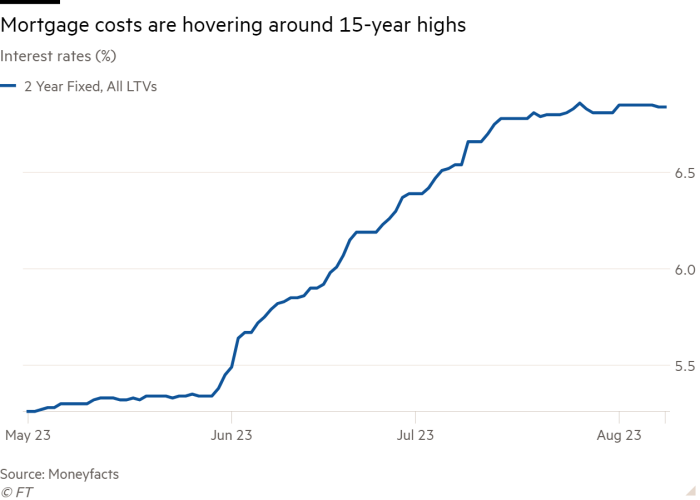

The reductions from the 4 massive suppliers will additional bolster hopes that mortgage charges have peaked, though debtors nonetheless face near-record prices.

Whereas the price of a two-year mounted mortgage has fallen just a few foundation factors from the 15-year excessive it reached at first of August, it’s nonetheless at 6.83 per cent, in contrast with 3.99 per cent a 12 months in the past and above the height reached final October within the wake of the “mini” Funds.

The most recent strikes mark the third week of mortgage price falls after knowledge final month confirmed UK inflation fell to a 15-month low in June, reversing a pointy enhance earlier within the 12 months pushed by considerations about persistent value pressures.

Mortgage charges have continued to fall regardless of the Financial institution of England lifting rates of interest to a 15-year excessive of 5.25 per cent final week as a result of suppliers base prices on the swaps market, which displays predictions of the long run degree of BoE charges. The extent at which borrowing prices are anticipated to peak early subsequent 12 months fell barely following the BoE resolution.

Lenders have additionally needed to minimize charges to compete because the market has slowed, with debtors adjusting their spending in response to the difficult financial surroundings.

“Increased charges means fewer mortgages for banks and constructing societies,” stated Aaron Strutt, director at dealer Trinity Monetary. “The folks we cope with on a day-to-day foundation would slightly charges have been decrease so they may do a bit extra enterprise.”

Smaller lenders Market Harborough Constructing Society and MPowered mortgages additionally stated on Tuesday that they have been chopping prices.

On a outcomes name final month, William Chalmers, Lloyds’ chief monetary officer, instructed reporters that the mortgage market had been quiet within the first half of 2023.

“Total new enterprise has been fairly sluggish within the first half of the 12 months [and] mortgage margins are at exceptionally low ranges,” he stated.

Brokers have additionally cautioned that main reductions in mortgage prices are unlikely within the quick time period, with inflation nonetheless excessive regardless of the promising knowledge for June and the BoE anticipating charges to stay greater for longer.

David Hollingworth, director at London & Nation Mortgages, stated suppliers must “see what subsequent 12 months brings”, including: “The underside line for debtors is they need to count on that charges usually are not going to return to the ultra-low ranges they’ve loved during the last 10 to fifteen years.”