When Alexandra Rodriguez requested her landlord to restore the hearth alarm in her rented flat in south London, she didn’t count on his response to be an eviction discover. But he despatched her a proper request to vacate the flat inside two months — then re-advertised it at a lease practically 40 per cent larger.

“They marketed the property on Rightmove at £1,800 per 30 days . . . that’s why they removed us,” mentioned the 37-year-old science technician, including that she was nonetheless “emotionally and financially” recovering from being pushed out of her house.

Her expertise echoes that of many Londoners who’re being hit with surging rents and even evicted as landlords go on stress from larger rates of interest. The private rented sector — on which the UK capital has develop into more and more reliant over the previous 20 years — is especially susceptible to larger charges due to the prevalence of interest-only buy-to-let mortgages, which helped create legions of middle-class landlords.

Rents in London are at their highest stage on document, far above these in the remainder of the UK and better than in lots of European capitals. London rents rose by a fifth between March 2020 and Might 2023, with the median price of a studio in Larger London reaching £1,275 per 30 days, in response to property brokers Savills.

A growth in demand for tenancies is being fuelled by document immigration to the UK and a wave of scholars pushed into personal leases by a shortage of student accommodation, say consultants.

Greater mortgage rates and the top of a authorities scheme supporting first-time patrons have in the meantime compelled extra would-be homebuyers into lettings, mentioned Richard Donnell, head of analysis at Zoopla.

“The affordability of house possession in London, the place you might want to be on a £100,000 revenue and [have] a £140,000 deposit to purchase, means lots of people are having to lease,” mentioned Donnell. UK home gross sales are on observe for his or her slowest year in more than a decade, in response to Zoopla.

Hovering demand means tenants are competing fiercely for houses. Neil Quick, head of London lettings at property agent JLL, mentioned they had been coming into bidding wars and providing to pay a number of months’ price of lease upfront.

“I’ve been doing lettings for the very best a part of 20 years and solely not too long ago have I seen an occasion the place we’ve needed to take a property off the market as a result of inside half an hour we generated viewings of 20 individuals,” mentioned Quick. “We had been inundated with inquiries. We needed to bodily cease [them].”

Including to the stress, the inventory of accessible houses to lease in London — already inadequate to fulfill demand — is vulnerable to shrinking after simply beginning to recuperate from a five-year low in 2022. About 4.8mn personal landlords present lodging for a fifth of UK households, mentioned Savills. Of these, greater than 1mn are in Larger London, the place they accommodate about 30 per cent of households.

Britain’s personal rented sector boomed within the 2000s after the rollout of buy-to-let mortgages. London’s excessive reliance on interest-only loans has made it susceptible to rising borrowing prices, that are placing landlords’ enterprise fashions beneath pressure.

The typical two-year buy-to-let residential mortgage fee within the UK rose from 4.5 per cent in August 2022 to six.6 per cent on the finish of August 2023, in response to Moneyfacts. That has damage landlords inside and out of doors London. Neil France, an Essex-based landlord with 4 buy-to-let properties, mentioned the rises in month-to-month funds had been “horrific” and compelled him to extend rents to keep away from making a loss. “We’ve got needed to exit to all of the households, sit down with all of the tenants [and] clarify to them the state of affairs,” he mentioned.

The hit to debtors follows regulatory adjustments that had already dimmed the enchantment of personal rental investments. The UK authorities scrapped tax reduction on buy-to-let mortgage curiosity in 2016, whereas landlords face the opportunity of new vitality effectivity necessities within the coming years, together with harder regulation of the rental market.

“The impression of [the 2016 tax change] is absolutely beginning to be felt right this moment, while you’ve acquired charges of 6 to 7 per cent that may’t be offset as an expense,” mentioned David Fell, analyst at property agent Hamptons.

Lenders repossessed 440 buy-to-let properties within the UK within the second quarter of 2023, up 7 per cent from the earlier quarter, whereas an extra 1,870 landlords had been behind on repayments by a sum totalling greater than 10 per cent of their excellent mortgage, in response to UK Finance.

“I can’t imagine anyone would go into buy-to-let now,” mentioned France. “I might query their sanity.”

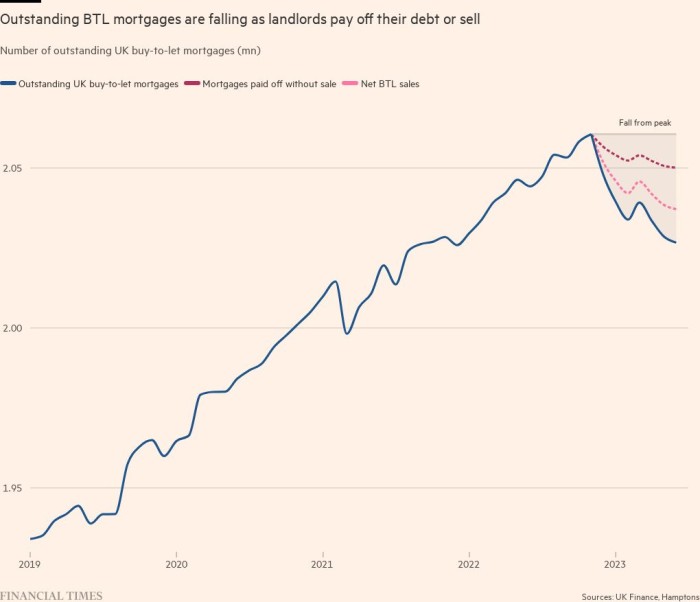

Excellent buy-to-let mortgages have fallen this 12 months as landlords repay their debt or promote properties to keep away from the blow from larger charges. In London, excessive mortgage prices make the returns on such properties decrease than elsewhere. “Sadly, we’re going to see lots of previous landlords promoting up,” mentioned Donnell.

Hamptons estimates that between one-third and half of houses offered by landlords stay within the personal rented market. A sell-off subsequently dangers additional squeezing provide, consultants warn. That might pile stress on to London’s most susceptible tenants, lots of whom depend on personal leases as a result of they can’t entry social housing.

A couple of quarter of UK tenants within the personal rental sector obtain authorities housing profit, in response to evaluation of presidency knowledge by Zoopla and the homelessness charity Disaster — the determine in London is 29 per cent.

“We haven’t constructed sufficient social housing during the last 20 years, so the personal sector development has absorbed unmet demand,” mentioned Zoopla’s Donnell. “As quickly because the rental market stops rising, it highlights an entire lot of issues.”

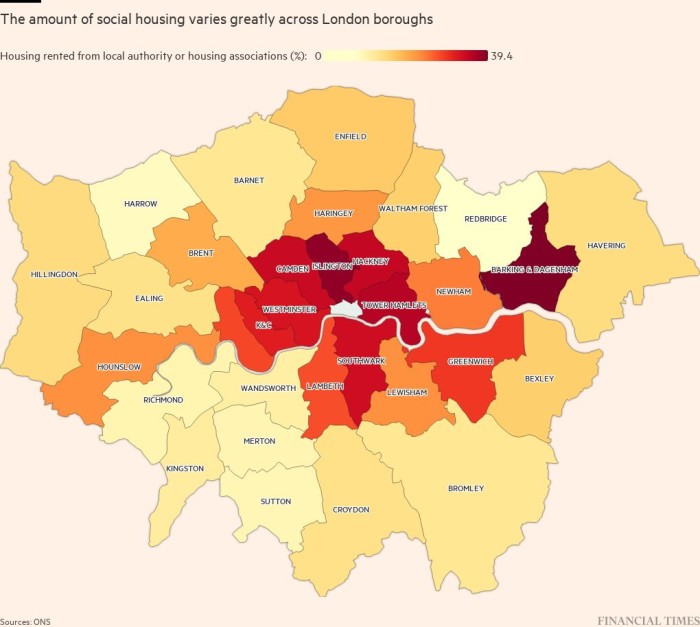

Inside London, the proportion of households in social housing — houses offered by councils and not-for-profit housing associations at rents linked to incomes — varies extensively by borough, from lower than 10 per cent in Redbridge to nearly 40 per cent in Barking and Dagenham.

Native housing allowances haven’t stored up with rising rents, so individuals on advantages can’t compete within the personal rental market, mentioned marketing campaign group Era Hire.

Additionally they danger having to search out new houses as a result of landlords in England can evict tenants with two months’ warning with out clarification from as little as six months into their tenancy.

Such evictions might be restricted beneath a renter’s reform invoice that’s going by means of parliament however the harder guidelines have made sluggish progress since they had been pledged in 2019. Era Hire mentioned free regulation made low-income households particularly susceptible.

Rents are rising all through London however are rising quickest on town’s outskirts in boroughs corresponding to Harrow, Sutton and Havering. “The large story in London is renters being pushed into outer London seeking affordability,” mentioned Donnell.

Hair stylist Solomon, 29, spent weeks frantically in search of a room after his landlord gave him discover to go away his Camberwell flat. After repeatedly being outbid, he determined to chop his losses and transfer to Basingstoke in Hampshire.

“I can both spend plenty of cash to be in London — in a spot I received’t be comfy in with damp and mildew that impacts my psychological well being — or I make the leap and transfer out of London and cope with commuting,” he mentioned.

Solomon, whose commute to Peckham in south London now takes greater than an hour, mentioned leaving the capital was the one means he might reside alone in a well-kept, functioning flat.

“My work and profession is in London, all my associates are there, however the issues I want at my stage in life are house and safety,” he mentioned. “London wasn’t in a position to present that for me any extra.”

Information visualisation by Chris Campbell and Martin Stabe

Excessive renting

That is the most recent a part of a series on Europe’s rental disaster: