Incomes cash whilst you sleep sounds dream-like, but that’s precisely what passive revenue streams can provide to devoted traders and entrepreneurs.

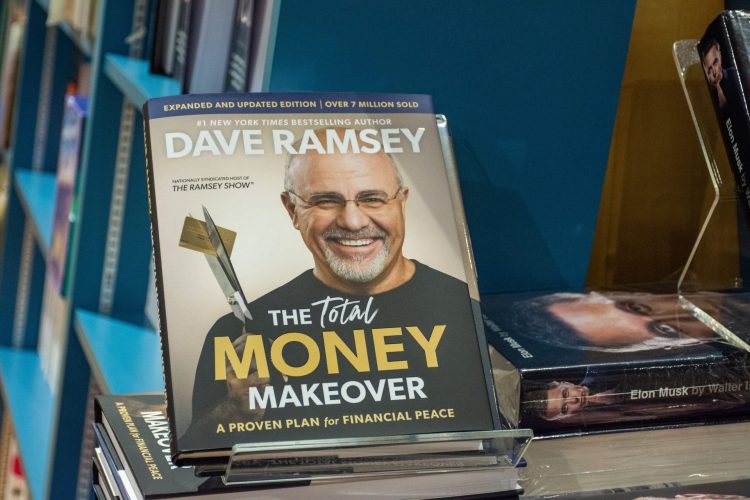

In response to monetary professional Dave Ramsey, these income sources usually demand preliminary time and sources however can ship returns for years with little upkeep.

Let’s discover the passive revenue avenues Ramsey recommends for constructing long-term monetary safety.

Professional Tip: Constructing passive revenue is sensible, however don’t overlook present burdens like tax debt. Alleviate Tax works straight with the IRS and should assist cut back what you owe. When you’re $10,000+ behind, answer a few questions to see if you qualify today!

1. Put money into REITs

When you like the thought of actual property revenue however need to keep away from property administration, take into account actual property funding trusts (REITs). These trusts personal and handle portfolios of income-generating properties, and you’ll make investments by buying shares.

REITs generate revenue via hire and property gross sales and provide dividends to traders. Publicly traded REITs are listed on inventory exchanges, making them an accessible strategy to diversify your portfolio.

Professional Tip: When you’ve bought $100,000 or extra to take a position, SmartAsset can match you with a fiduciary advisor to construct a technique tailor-made to your objectives.

2. Develop wealth with low-turnover mutual funds

Low-turnover mutual funds present a passive strategy to develop your cash over time. Managed by skilled fund managers, these funds preserve a secure portfolio with restricted shopping for and promoting exercise.

This technique may end up in fewer capital beneficial properties taxes and long-term progress. It’s a superb selection for many who need their investments to work for them with out frequent administration.

Professional Tip: When you’re drawn to regular, long-term progress like low-turnover mutual funds provide, take into account including a hedge towards financial downturns by opening a gold IRA to assist defend your wealth throughout recessions and monetary instability.

3. Generate revenue with actual property

Proudly owning actual property means that you can earn rental revenue, however Ramsey suggests a cautious strategy. He recommends paying off your individual dwelling first after which buying funding properties with money to keep away from debt.

You don’t want to stay to investing in residential properties. Industrial properties typically have larger capitalization charges, that means larger returns after prices. Ramsey additionally advises investing regionally and dealing with a property administration firm to simplify operations.

Professional Tip: Investing in actual property doesn’t need to imply shopping for property. Fundrise allows you to put money into actual property beginning with simply $10.

4. Earn from customized product designs

When you’re inventive, strive designing merchandise for websites like Zazzle or Teespring. These platforms deal with printing and delivery whilst you earn a lower of every sale.

Create distinctive designs for mugs, t-shirts, or posters, and let the platform deal with the logistics.

Nevertheless, remember the fact that success on this house might take time. Many creators on these platforms report modest earnings, however others generate regular revenue with persistence and interesting designs.

Professional Tip: Whereas your designs work to earn passive revenue, make your cash work too. Begin investing with as little as $1 and no commissions utilizing this popular app – sign up today to diversify into shares, crypto, artwork, and extra.

5. Flip your pastime right into a income stream

Do you have got a ability or ardour others need to be taught? Create an internet course on platforms like Udemy, the place you possibly can earn cash each time somebody enrolls.

Writing an e-book to promote on Amazon or posting tutorial YouTube movies are different methods to monetize your information.

Your pastime can evolve into a gradual revenue supply with some upfront effort.

Professional Tip: When you’re beginning a aspect gig, use Lively HSAs to save lots of on healthcare prices with a high-deductible well being plan.

Begin constructing passive revenue at present

Passive revenue isn’t a get-rich-quick scheme — it requires effort upfront that may repay in the long term.

Whether or not investing in actual property or monetizing your expertise, these methods will help you earn extra whereas specializing in what issues most. Begin small, keep constant, and watch your monetary independence develop.

Professional Tip: When you’ve bought greater than $100,000 in financial savings, get some recommendation from a professional. SmartAsset provides a free service that matches you to a vetted, fiduciary advisor in lower than 5 minutes.