Keep knowledgeable with free updates

Merely signal as much as the UK home costs myFT Digest — delivered on to your inbox.

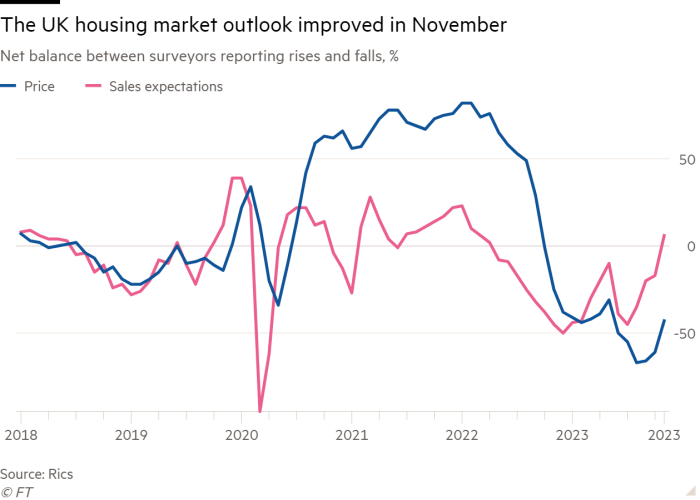

The outlook for the UK housing market improved in November as mortgage charges eased, marking the primary growth of gross sales expectations since early 2022, in line with a property survey.

The Royal Establishment of Chartered Surveyors mentioned on Thursday that its measure of forecasted gross sales over the following three months rose to 6 in November, up from minus 17 in October. It was the primary optimistic studying since April 2022.

The survey measures the distinction between the proportion of UK surveyors registering rises and falls in house gross sales.

The report was revealed hours forward of the newest resolution by the Bank of England’s Financial Coverage Committee, which is anticipated to go away rates of interest unchanged at a 15-year excessive of 5.25 per cent.

The Rics knowledge recommended the enhancements out there, mirrored in rising house prices and mortgage approvals, would proceed into the months forward as mortgage charges fall again farther from their summer time peak.

Simon Rubinsohn, Rics chief economist, mentioned the advance had been “aided by elevated confidence that the rate of interest cycle has peaked, which is mirrored in considerably extra aggressive mortgage merchandise coming to the market”.

Two-year mounted mortgage charges with a 60 per cent loan-to-value ratio eased from 6.2 per cent in July to five.5 per cent in October, whereas charges on five-year offers have additionally declined for the reason that summer time, in line with the BoE.

Analysts mentioned the market had been boosted by expectations of an additional fall in rates of interest.

Tom Invoice, head of UK residential analysis at Knight Frank, mentioned: “Hypothesis is popping to the timing of a financial institution charge reduce somewhat than the scale of the following rise, offering a lift to sentiment which means transaction volumes needs to be increased over the following six months than the final six.”

Property brokers’ gross sales expectations over the following 12 months rose to 24 in November, from zero within the earlier month, and have been their most upbeat since January 2022.

Their evaluation for home costs over the previous three months remained damaging at minus 43. This marked a pointy enchancment from the minus 61 registered in October.

Home value expectations for the 12 months forward additionally picked as much as minus 10 in November from minus 43 within the earlier month.

Rental costs, which have surged this 12 months due to robust demand from households that can’t afford a mortgage, additionally confirmed indicators of stabilising.

The survey reported a discount in tenant demand and value expectations even because the variety of new landlords’ directions to brokers remained in decline.

John Halman, chair at Gascoigne Halman property brokers, mentioned the tip of the 12 months had ushered in a slight enhance in exercise in contrast with earlier expectations. “It seems rates of interest could have peaked, which helps.”

Separate knowledge this week confirmed that mortgage arrears had elevated to their highest charge in six years in September, in line with Financial institution of England knowledge. The elevated mirrored the impact of upper rates of interest on family funds.