Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

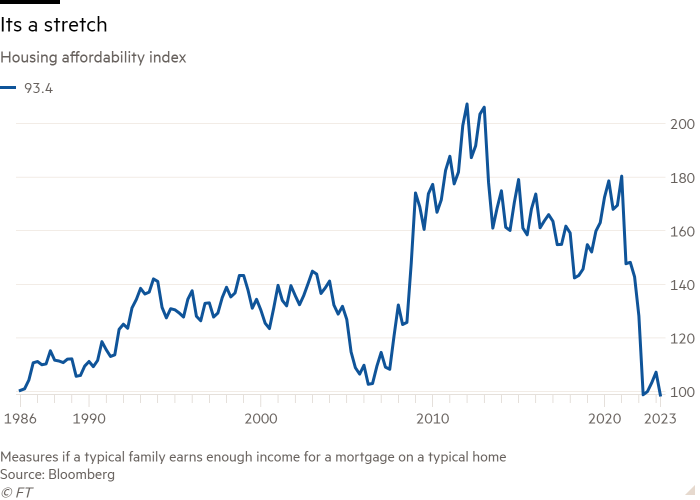

There are various metrics to point out how distorted the US housing market has turn into. Regardless of borrowing prices hitting 20 12 months highs, costs are hovering close to report ranges with benchmarks of the affordability of dwelling possession on the lowest ranges in additional than 30 years. Gross sales exercise has slumped to ranges not seen outdoors main monetary crises.

Might an uncommon however a lot lauded characteristic of the US housing market have contributed to the scenario?

Thirty-year, fixed-rate mortgages dominate within the US and are chosen by round 90 per cent of all homebuyers. To their followers, they’re a cornerstone of the American dream. In nearly all over the place else on the planet, dwelling consumers can solely dream of 1 as they pay principally floating charges or face shorter reimbursement phrases. Within the US, they’re largely potential solely by authorities intervention, since most of the loans find yourself being assured by authorities companies Fannie Mae and Freddie Mac.

However they’ve turn into a sizzling matter within the US due to the sharp drop in homes on the market. With about three-quarters of householders paying 4 per cent or much less on their mortgages, they’re “trapped” of their present houses as a result of a brand new mortgage means paying greater than 7 per cent. This has depressed the variety of homes on the market, supporting excessive costs.

A current essential column in the New York Times on 30-year mortgages prompted a punchy response in The Nation days later from economist James Galbraith. Supporters resembling Galbraith contend that owners deserve safety and that lenders have way more methods to put off the dangers of a mortgage.

“It simply reduces the uncertainty of homeowning, which in fact was the purpose,” he says. “What you get because the borrower is assurance that for no matter indefinite interval you (select) . . . you’re not topic to the draw back threat.”

Detractors warn that aside from limiting provide of properties on to the market when rates of interest are rising, 30 12 months mortgages can push up home costs since spreading repayments over a long term, than say the 20 years extra widespread in different nations, raises the overall quantity a borrower can afford to borrow, permitting them to bid extra.

These components make life more durable for lower-income debtors, together with first-time consumers, who face a market with fewer appropriate houses and strained affordability.

Since 2012, low-priced houses tracked by the American Enterprise Institute, have seen costs rise 150 per cent, about half as a lot once more as homes in a medium-high priced bucket. Provide is a giant issue: the low-priced finish of the market just isn’t builders’ most worthwhile worth level.

The worth rises have strained debt ranges relative to earnings, organising a higher quantity for defaults. Foreclosures are extra possible within the early years of any mortgage when sustaining funds is usually a higher battle. Its additionally the interval throughout which the construction of 30-year mortgage funds hurts most: since curiosity is charged on the excellent mortgage quantity, extra of every cost covers that, not fairness, in these early years, leaving a booted-out borrower with much less for his or her efforts.

5 years of paying a 30-year mortgage of $326,000 — the highest of the AEI’s low worth bucket — on the present new mortgage common price of seven.17 per cent would internet a borrower about $19,000 of fairness in that point, not together with any worth appreciation or down cost. Had the mortgage time period been 20 years as an alternative, a borrower would have $44,000 paid off as a result of the general curiosity invoice is a lot smaller.

“The low finish is sort of a rollercoaster, whereas the upper finish is extra like gliding by as they’ve the endurance — the higher credit score and the decrease debt service (ranges),” says Edward Pinto, head of the AEI’s Housing Middle and a longtime critic of the fixation with 30-year mortgages. “Decrease-income debtors are normally final in throughout a market upcycle and lower-priced houses are inclined to have extra (worth) volatility.”

Nevertheless, the 30-year fixed-rate offers don’t seem to have had a lot of an affect on precise dwelling possession ranges. About two-thirds of Individuals have a mortgage or personal their place outright, in line with the OECD. That’s in keeping with Canada and the UK — two nations equally eager on dwelling possession however which usually provide short-term fixed-rate “teasers” earlier than reverting to floating charges.

For all of the heated debate, adjustments to this specific piece of American exceptionalism appear unlikely any time quickly, not least because the US enters an election 12 months. Individuals are additionally extraordinarily keen on their fixed-rate certainty. “Its simply so good,” stated one American, a fellow FT columnist, of his dwelling mortgage. It might not have the strongest monetary foundations, however that feeling might be the largest block to any change.

jennifer.hughes@ft.com