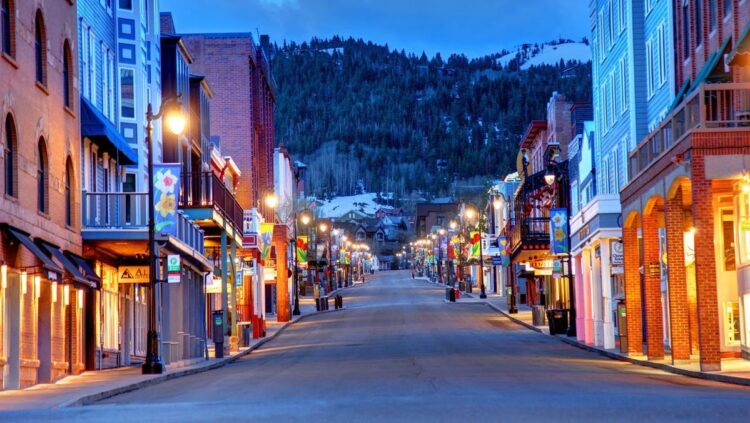

Park Metropolis, in Summit County, Utah, a playground of the wealthy and well-known, will profit from new … [+]

The nation faces a crucial scarcity of not solely inexpensive housing, however workforce housing. Nowhere is that shortfall extra pronounced than in America’s prime ski cities. Playgrounds of the ultra-rich, these hamlets have endured an ever-worsening dearth of housing for the individuals who work within the resorts and eating places, in addition to the oldsters who workers police, fireplace and EMT departments, hospitals, colleges, and libraries.

Ski capital and year-round vacationer draw Park Metropolis, Utah has just lately served as a poster baby for the housing mismatch. In Park Metropolis, the shortage of workforce housing has grow to be so dire lately that in keeping with stories, solely 15 % of town’s workforce reside throughout the metropolis limits. One report discovered a dozen seasonal staff forked out $1,000 a month every to share a one-bedroom Park Metropolis condo. An area actual property growth agency has stepped as much as handle the scenario with an progressive resolution. However first, let’s have a look at housing initiatives in a pair different nice American ski meccas.

New efforts

Various municipalities are taking motion to make sure housing is accessible for staff comprising the spine of the workforce in ski cities favored by the one %. One of many world’s costliest ski cities, Aspen, Colo., is welcoming an initiative referred to as the Aspen Lumberyard Reasonably priced Housing undertaking, slated to ship 277 new housing items which can be inexpensive for on a regular basis individuals working within the metropolis.

In the meantime, the city council of Breckenridge, Colo. has launched a brand new program designed to help townspeople in acquiring inexpensive housing.

Town’s Housing Helps initiative is offering incentives to actual property patrons and owners encouraging them to deed prohibit their market charge properties, thereby serving to make sure the continued availability of housing for locals.

Additionally in Breckenridge, a twin-phase inexpensive housing growth referred to as Alta Verde noticed 80 flats delivered final 12 months, inexpensive for these with incomes at 60% of Space Median Incomes (AMI). This growth is near full lease-up.

Section II, slated for completion in 2024, will function 174 rental housing items unfold throughout 4 buildings. Half the items might be inexpensive for people and households incomes 80% of AMI.

New enclave

Crandall Capital’s Studio Crossing undertaking in Park Metropolis, Utah, slated to interrupt floor in 2024.

Again in Park Metropolis, homegrown firm Crandall Capital has dedicated itself to the mission of addressing town’s housing mismatch. The corporate’s new undertaking, Studio Crossing, will break floor subsequent 12 months. A 320,000-square-foot sustainable growth providing housing, retail and eating, the undertaking additionally requires open-air neighborhood areas.

Studio Crossing will consequence within the creation of a wholly new Park Metropolis enclave, providing inexpensive flats and market-rate townhouses and condominiums.

Crandall Capital will develop the inexpensive studio to three-bedroom flats with out utilizing state or native tax {dollars}. The event can even supply 50 market-rate two- or three-bedroom townhomes meant for town’s working professionals and older adults in search of to retire within the metropolis they’ve referred to as dwelling for years.

As well as, Studio Crossing will function retail and eating house for locally-cultivated storefront retailers, eating places and repair companies, meant to offer Park Metropolis with a various combine of economic enterprises enriching the neighborhood. Extra parts of the bold plan embody environmentally pushed initiatives akin to a public transit station with service to downtown Park Metropolis in addition to Salt Lake Metropolis. The eco-conscious combine can even embody electrical automobile ports, an e-bike share program, low-emitting constructing supplies and water-wise plantings, amongst different options.

“This undertaking addresses so many wants of Park Metropolis, whereas contemplating the surroundings to guard the pure fantastic thing about the realm, two core values that drive our planning for each undertaking we tackle,” says Gary Crandall, who with sons Ryan and Matthew holds the reins at Crandall Capital.