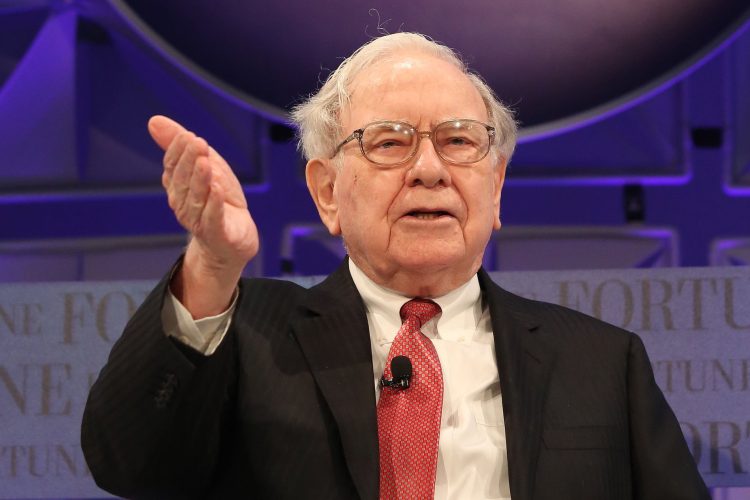

Warren Buffett’s monetary knowledge has made him one of many world’s most profitable buyers. His sensible spending and saving methods may help anybody construct long-term wealth.

Making use of these ideas can strengthen your monetary safety, develop your financial savings, and make smarter cash choices—with out sacrificing your way of life.

Professional Tip: Want additional money or a wiser option to handle bills? Discover tailor-made monetary options—quick, straightforward, and safe. Explore financial solutions here.

1. Drive your automotive into the bottom

Buffett retains his vehicles for years, typically shopping for used fashions as an alternative of splurging on new ones. Vehicles lose worth shortly, making used autos a wiser monetary transfer.

Correct upkeep can lengthen a automotive’s lifespan, saving hundreds over time. Maintaining with common oil adjustments, tire rotations, and minor repairs can hold a automotive operating effectively for years.

Moreover, avoiding pointless upgrades and driving cautiously may help protect the car’s situation. A well-maintained automotive lasts longer and retains extra resale worth when it’s time for an improve.

Professional Tip: Sudden automotive repairs can shortly drain your financial savings, particularly as autos grow to be costlier to repair. In order for you peace of thoughts and safety from excessive restore prices, contemplate the price/advantage of an extended car warranty. It might provide help to keep away from paying hundreds out of pocket for main breakdowns.

2. Keep away from bank card debt just like the plague

Buffett has by no means carried a bank card stability, warning that high-interest debt can kill wealth-building. Bank card debt is among the greatest cash traps, with excessive charges making it tough to repay balances shortly.

Paying off bank cards in full every month, avoiding pointless debt, and utilizing credit score strategically can forestall monetary stress.

Monitoring your credit score utilization and profiting from rewards packages with out overspending also can enhance your monetary well being. Accountable credit score administration saves cash on curiosity and helps keep a robust credit score rating for future alternatives.

Professional Tip: Excessive-interest debt generally is a main roadblock to monetary stability, making it essential to discover a plan for paying it down effectively. When you’ve got greater than $20,000 in unsecured debt, in search of skilled steering may help you regain management of your funds. National Debt Relief is a trusted supply without cost recommendation and help.

3. Use reductions and offers every time attainable

Even billionaires search for offers. Invoice Gates as soon as shared a narrative about Buffett paying for his or her McDonald’s meal with coupons, proving {that a} whole lot is at all times value it.

Cashback apps, digital coupons, and loyalty packages can result in easy financial savings. Many retailers supply automated reductions for signing up for emails or utilizing retailer apps. A number of small adjustments in buying habits can result in noticeable long-term financial savings.

Professional Tip: Even billionaires respect the worth of a great deal. Slash bills on eating, journey, eyeglasses, prescriptions, and extra with AARP for simply $15/12 months with auto-renewal. Join now and save hundreds.

4. Purchase on sale—even should you’re a billionaire

Buffett has famously mentioned, “Whether or not we’re speaking about shares or socks, I like shopping for high quality merchandise when it’s marked down.” Purchasing smarter by ready for gross sales, profiting from seasonal reductions, and shopping for in bulk when costs are low is a good way to maximise financial savings.

In search of offers doesn’t imply compromising high quality—getting extra for much less.

Evaluating costs, utilizing coupons, and leveraging cashback or rewards packages can additional stretch your price range. Growing a behavior of strategic buying ensures you get the most effective worth whereas holding more cash in your pocket.

Professional Tip: Shopsmart on auto protection. Use a car insurance shopping site to seek out cheaper insurance coverage and doubtlessly save as much as $600 a 12 months, permitting you to maintain more cash in your pocket.

5. Restrict eating out—keep on with easy meals

Buffett enjoys routine, cheap meals fairly than frequent effective eating. He has been identified to eat McDonald’s breakfasts as an alternative of pricey brunches, proving that small financial savings add up.

Cooking at house saves a fortune in comparison with consuming out usually. Meal planning, batch cooking, and holding inexpensive staple components readily available may help keep a price range with out sacrificing good meals.

Habits like brewing espresso at house, packing lunches, and limiting takeout can result in vital long-term financial savings. Plus, home-cooked meals typically present higher diet and portion management, benefiting your pockets and well being.

Professional Tip: Life Line Screening reveals hidden dangers so you may act early. Book a screening today and have peace of thoughts.

6. Get artistic together with your retirement technique

Buffett advocates for sensible monetary methods to make sure long-term stability. Whereas his wealth comes from investing, he stresses maximizing present property.

Opposite to reducing prices in retirement, leveraging present assets may be key. Householders would possibly use house fairness for revenue to cowl bills with out promoting their property.

Choices like reverse mortgages or renting a portion of the house supply extra monetary flexibility, enabling retirees to remain of their properties.

Professional Tip: Your house may be greater than only a place to reside—it may be a monetary device in retirement. A reverse mortgage permits seniors 62+ to entry tax-free money from their house fairness with out promoting their home or taking up month-to-month funds. Whether or not you want funds for medical payments, house enhancements, or perhaps a long-awaited trip, this selection can present monetary flexibility whereas letting you keep in your house.

7. High quality over amount

Buffett believes in shopping for fewer, higher issues. His funding philosophy applies to on a regular basis purchases—low-cost, low-quality objects find yourself costing extra over time after they break or put on out shortly.

The next upfront price for a well-made product may be value it if it lasts longer and performs higher. This precept works for every part from sneakers to home equipment. Spending properly means trying past the value tag and contemplating how lengthy one thing will final.

Professional Tip: Concentrate on high quality over amount in your investments. Shield your wealth by hedging towards financial downturns and monetary uncertainties by opening a gold IRA.

8. Don’t waste cash on traits

Buffett avoids fads in each investing and each day life. As an alternative of chasing what’s standard, he sticks to timeless classics and ignores hype. Developments come and go, however high quality and practicality by no means exit of favor.

The most recent devices, quick style, and stylish house décor would possibly really feel thrilling within the second, however they typically lose worth shortly. Sticking to well-made fundamentals saves cash in the long term.

Professional Tip: Concentrate on timeless worth in each purchases and investments. One fashionable option to diversify your portfolio is thru actual property and enterprise capital. Corporations like Fundrise supply investments as small as $10.

9. Hustle like Buffett—by no means cease studying

Buffett didn’t grow to be one of many world’s richest folks by luck. He began early, delivering newspapers as a young person, and labored tirelessly all through his life. Even now, he spends most of his time studying and studying, believing information is the best funding.

His work ethic and fixed self-improvement have been key to his monetary success. He understands that success isn’t nearly creating wealth however constantly rising and adapting to new alternatives.

If you happen to’re seeking to increase your revenue or sharpen your expertise, contemplate taking up a aspect gig, studying a brand new commerce, or discovering versatile work alternatives that suit your way of life

Professional Tip: Incomes additional revenue doesn’t must imply lengthy hours or a annoying commute. If you happen to’re on the lookout for versatile, part-time, or distant work alternatives, FlexJobs affords entry to verified job listings that suit your way of life—whether or not you’re looking out regionally or globally.

Buffett’s billionaire mindset: Save sensible, reside effectively

You don’t want billions to make use of Buffett’s greatest habits. The key to wealth isn’t simply how a lot you make—it’s how a lot you retain.

You may reside wealthy, even on a mean price range by specializing in worth, high quality, and sensible spending. Small, constant monetary choices—like avoiding debt, investing early, and spending properly—can result in long-term monetary safety.

Professional Tip: You don’t should be a billionaire to undertake smart monetary habits. Save time, cash, and stress whereas defending your loved ones with sensible choices. Where there’s a will, there’s a way.