Social Safety is likely one of the most significant monetary instruments for thousands and thousands of People, but it’s typically shrouded in confusion. With so many questions on the way it works, when to assert, and how you can benefit from your advantages, it’s no shock that many individuals are uncertain of the place to start out.

Whether or not you’re getting near retirement age or planning forward, understanding the ins and outs of Social Safety can assist be certain that you’re making the most effective choices on your monetary future.

On this article, we’ll reply the seven most typical Social Safety questions everybody asks—and supply some private tales to assist clarify each. These solutions can assist make clear your path ahead and offer you a greater concept of how you can maximize your advantages. Let’s dive in!

1. How Do I Qualify for Social Safety Advantages?

To qualify for Social Safety advantages, you have to have labored and earned a selected variety of credit all through your profession.

Usually, 40 credit (or 10 years of labor) are required to start out receiving retirement advantages. Your earnings throughout these years can even decide the quantity you obtain, so it’s essential to maintain monitor of your work historical past.

You’ll be able to repeatedly overview your Social Safety assertion to examine the variety of credit you’ve amassed and get an estimate of your future advantages. It’s all the time smart to remain on high of your data to make sure you’re on monitor for retirement.

Professional Tip: Whereas managing your Social Safety advantages, don’t overlook about your healthcare protection. In the event you’re nearing retirement age, it’s a good suggestion to check Medicare plans to make sure you’re getting the most effective protection on your wants. Compare plans today.

2. When Ought to I Begin Claiming Social Safety?

Some of the continuously requested questions is when to start claiming Social Safety. Whereas the earliest you may start claiming is at age 62, claiming early means receiving a decreased profit. You’ll obtain your full profit for those who can wait till full retirement age (between 66 and 67, relying in your delivery 12 months).

Nonetheless, it’s essential to notice that delaying your declare could possibly be helpful. Annually you wait past your full retirement age, your month-to-month cost can enhance by as a lot as 8% till you attain 70. This implies suspending your advantages might considerably enhance your monetary scenario and supply extra earnings later in life.

3. How Does Social Safety Work for Spouses?

Social Safety advantages can be prolonged to spouses, offering a vital security web. In case your partner has labored and paid into Social Safety, you could possibly declare as much as 50% of their profit quantity whenever you attain full retirement age.

In the event you’ve been married to somebody with the next lifetime earnings document, you may file for spousal advantages and obtain greater than you’d for those who relied by yourself document. Nonetheless, for those who remarry earlier than age 60, you could not qualify for spousal advantages.

You should definitely examine whether or not you’re eligible for spousal advantages. This generally is a important monetary benefit, notably in case your partner’s earnings have been increased than yours.

4. Will Social Safety Be Sufficient for Retirement?

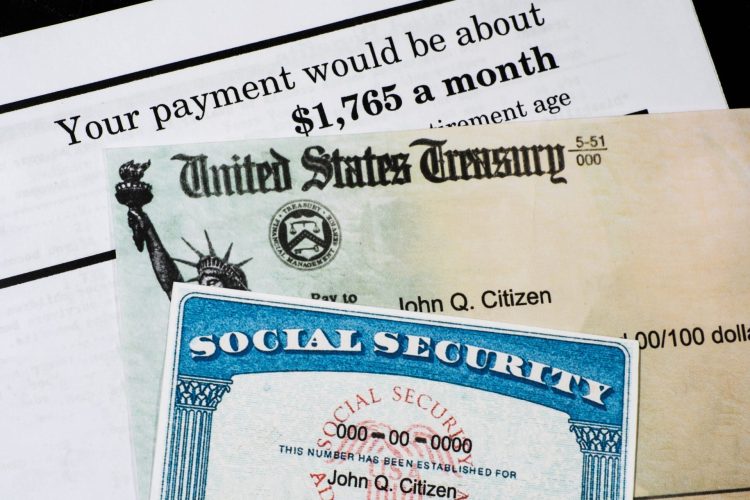

Social Safety is supposed to be a security web, however it’s unlikely to offer sufficient for most individuals to reside comfortably by retirement. The typical month-to-month profit is round $1,500—which can cowl some prices, however it’s typically not sufficient to maintain your life-style whereas working.

Many retirees discover that they should depend on further sources of earnings to make ends meet. Build up a private financial savings account or contributing to an employer-sponsored retirement plan can assist present that further cushion to keep up your way of life all through retirement.

Professional Tip: To make your financial savings work more durable, take into account accounts that supply increased rates of interest. For instance, SoFi Checking presents a aggressive 4% rate of interest, together with a possible $300 signup bonus—a straightforward solution to maximize your emergency financial savings. (Charges might change with out discover.)

5. Can I Work and Gather Social Safety on the Identical Time?

Sure, you may proceed working whereas gathering Social Safety advantages. Nonetheless, there are some issues to bear in mind. In the event you begin claiming advantages earlier than your full retirement age and earn greater than a sure threshold, your Social Safety funds could also be decreased briefly.

Instance: For 2025, the brink is $21,240, and also you’ll lose $1 for each $2 you earn over that quantity. After you attain full retirement age, you may earn as a lot as you want with no discount in advantages.

In the event you’re planning to maintain working, take into account how your Social Safety earnings will likely be impacted. In the event you’re nearing full retirement age, it might be value delaying your declare to maximise your month-to-month profit. Moreover, persevering with to work might enhance your lifetime earnings document, which can lead to increased advantages down the highway.

6. Will Social Safety Be Taxed?

Sure, Social Safety advantages might be taxed, relying in your general earnings. A few of your advantages could also be topic to federal earnings tax in case your whole earnings exceeds sure thresholds. Control your earnings ranges to keep away from surprising tax payments. In the event you’re nearing these thresholds, different methods to cut back your taxable earnings is perhaps value contemplating.

For single people, in case your earnings exceeds $25,000, as much as 50% of your advantages could also be taxable. In the event you earn over $34,000, as much as 85% of your advantages could also be taxable. For married {couples} submitting collectively, the brink is as much as $44,000.

It’s a good suggestion to seek the advice of with a monetary advisor or tax skilled who can assist you decrease your retirement tax burden.

Professional Tip: Sudden prices can come from many locations, together with car repairs. In the event you’re anxious concerning the expense of automobile repairs sooner or later, consider an extended car warranty to assist cowl surprising restore prices, so that you’re not caught off guard financia

7. What Occurs if I Go Away Earlier than I Begin Claiming?

In the event you go away earlier than claiming Social Safety advantages, your partner or dependent kids should still be eligible for survivor advantages. These advantages can help your family members financially, serving to them preserve stability after your passing.

For a surviving partner, the advantages can start as early as age 60 (or 50 if they’re disabled), they usually can obtain as much as 100% of the deceased partner’s profit. Dependent kids below 18 (or as much as age 19 if nonetheless in highschool) can also obtain survivor advantages.

It’s essential to plan and perceive how these advantages work, as they can assist defend your loved ones’s monetary future.

Securing Your Social Safety Future

Understanding how Social Safety works is essential whether or not you’re approaching retirement or simply beginning your profession. From spousal advantages to tax implications, answering these seven questions can assist you make knowledgeable choices that may affect your monetary safety for years to return.

Ensure that to repeatedly examine your Social Safety assertion and sustain with any modifications to this system so you may plan accordingly. Keep in mind, it’s by no means too early to start out serious about your retirement and making your cash be just right for you.

Take a number of moments now to examine your Social Safety earnings document. It’s essential to maintain tabs in your future advantages to keep away from surprises when retirement comes round! And for those who’re uncertain the place to start out, take into account looking for steerage from a monetary advisor that will help you maximize your advantages and safe a cushty retirement.