Congrats! You’ve acquired a terrific side hustle idea … now you simply want cash to get it off the bottom.

Regardless that many small companies can have fairly low startup prices, most will nonetheless require not less than some startup capital.

And having sufficient cash to begin and develop your small business is essential. In keeping with a latest research by CB Insights, 38% of startups fail as a result of they will’t increase new capital. Equally, “cash” is constantly among the many top struggles for side hustle founders.

On this information, I’ll share the preferred methods to fund your new enterprise, so you’ll be able to select the trail that makes probably the most sense for you.

I’ll additionally share real-life examples of how a number of the largest manufacturers on the planet acquired the funding they wanted to develop.

Prepared? Let’s do it!

3 Major Forms of Startup Funding

There are three major varieties of financing for brand spanking new companies:

- Bootstrapping

- Debt financing

- Fairness financing

The primary distinction between them is possession.

Bootstrapping is about investing your private money and funding streams.

Debt finance includes borrowing cash from an exterior supply like a financial institution. You conform to repay the borrowed quantity plus curiosity over a set interval.

Each these choices help you keep management of the enterprise.

However, fairness finance includes promoting shares or possession stakes to buyers. This implies you’ll be able to entry funds with out incurring debt. However you’ll must share possession and potential future income with buyers.

1. Bootstrapping: Construct From the Floor Up

Bootstrapping is how most small companies and side hustles get began.

As an alternative of in search of funds from buyers or lenders, you rely by yourself cash and onerous work to construct your small business.

In keeping with the U.S. Chamber of Commerce, 78% of small business owners use their very own funds to begin their companies. Bootstrapping is how I began my first enterprise, and the way the overwhelming majority of Side Hustle Show friends began theirs.

Bootstrappers take a lean strategy. You give attention to the necessities, trim pointless bills, and ensure each cent counts. It’s about being resourceful, stretching your {dollars}, and studying to do extra with much less.

Actual-Life Instance: Mailchimp

In 2001, Ben Chestnut and Dan Kurzius co-founded Mailchimp with just $700 of their very own cash. Moderately than in search of exterior funding, Mailchimp reinvested income and lower prices wherever potential.

They began in a small condo, dealing with every part from coding to buyer help.

Mailchimp has grown right into a platform that serves tens of millions of shoppers worldwide. They’ve achieved unbelievable success, all whereas retaining possession of their firm.

Suggestions for Bootstrappers

- Begin Lean: Give attention to the necessities and keep away from pointless bills. Hold your overhead prices low and prioritize what’s essential for your small business to perform.

- Do-It-Your self (DIY): Tackle duties which you can deal with your self initially. It’s a chance to be taught important abilities that can make it easier to run your small business.

- Negotiate All the pieces: Attempt to get one of the best offers with suppliers, distributors, and contractors. Small financial savings can add up over time.

2. Associates and Household: Get Assist From Your Interior Circle

Family and friends wish to see you succeed. They are able to supply monetary backing that can assist you begin your small business.

A latest research from Clutch discovered that 22% of founders acquired funding from mates or household within the first three months of launching their companies.

However this isn’t one thing you wish to rush into — the very last thing you need is to pressure relationships with individuals near you.

You’ll want to be as open and clear as potential. Share your imaginative and prescient for the enterprise, and description the potential dangers and rewards. Transparency is important to make sure everyone seems to be on the identical web page.

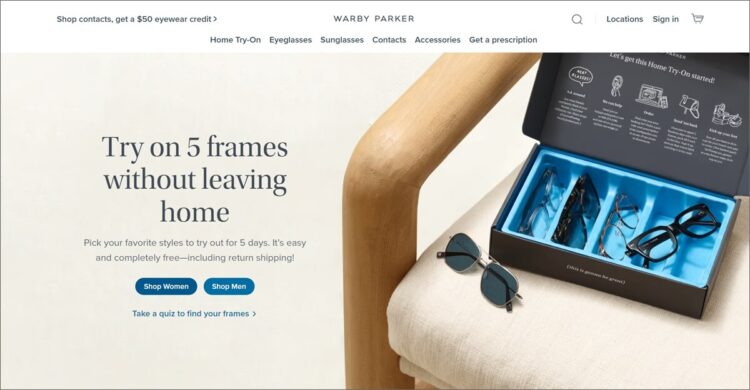

Actual-Life Instance: Warby Parker

The eyewear firm Warby Parker is an inspiring real-life instance of how help from family and friends can result in success.

In 2010, 4 mates, Neil Blumenthal, Andrew Hunt, David Gilboa, and Jeffrey Raider, got here along with a imaginative and prescient. They wished to promote trendy, reasonably priced eyewear whereas positively impacting the world.

On the outset, they turned to their friends and family for funding. A good portion of their preliminary seed capital got here from this supportive community.

At present, Warby Parker has disrupted the eyewear business and is a globally acknowledged model.

Suggestions for In search of Funding from Associates and Household:

- Be Clear and Trustworthy: Mixing your small business and private life at all times comes with challenges. Be trustworthy and open about your marketing strategy and the potential dangers and rewards.

- Deal with it Professionally: You’re getting into a authorized settlement, so deal with it professionally. Meaning formalizing agreements in writing and clarifying expectations.

- Ship on Your Guarantees: In the event you decide to repaying a private mortgage or offering a return on funding by a sure date, be sure to ship.

3. Enterprise Credit score Playing cards: Handy Money Movement Funding

Business credit cards work equally to private bank cards. You possibly can entry a revolving line of credit score to make purchases, handle bills, and tackle money move gaps.

It’s a preferred strategy to entry credit score. Round 67% of small business owners at present have a enterprise bank card.

They usually include perks like cashback, journey factors, or reductions on business-related purchases.

Whereas enterprise bank cards is usually a useful funding device, they’ve potential pitfalls. You’ll have to sustain with month-to-month repayments and use them responsibly to keep away from falling into debt traps.

Actual-Life Instance: Are You Watching This?!

When Mark Philip launched his real-time sports analytics company in 2007, the monetary disaster was simply getting began.

He was unable to lift cash from conventional routes, so he used enterprise bank cards to support early growth.

Nonetheless, it wasn’t till 2013 that Mark made his closing bank card compensation. Bank cards might be useful to cowl short-term prices, but it surely’s simple to mount up money owed.

Suggestions for Utilizing Enterprise Credit score Playing cards:

- Make Well timed Funds: Pay bank card payments on time to take care of a optimistic credit score historical past and keep away from late charges.

- Separate Enterprise and Private Bills: Hold your small business and private bills separate. Get a devoted enterprise bank card to keep away from confusion and simplify bookkeeping and tax reporting.

- Take Benefit of Promotional Affords: Some bank cards supply an introductory interval with 0% charges on purchases or stability transfers. This may be helpful you probably have important enterprise bills arising or wish to consolidate current debt. Simply make sure you repay the stability earlier than the promotional interval ends.

4. Financial institution Loans: The Conventional Funding Route

Enterprise loans are a tried and examined strategy to safe capital. In 2021, 34% of small businesses utilized for a mortgage.

A financial institution mortgage gives a lump sum that have to be repaid over a specified interval, often with curiosity.

From conventional time period loans to Small Business Administration (SBA) loans, every kind of financial institution mortgage serves completely different functions.

Elements like rates of interest and collateral necessities play an important position in deciding which possibility is true for your small business.

Actual-Life Instance: Patagonia

Patagonia is a wonderful instance of a enterprise that utilized financial institution loans to gasoline its growth. Within the early Nineties, the well-known out of doors clothes firm skilled a major improve in product demand.

Patagonia sought financing by means of financial institution loans to maintain up with demand and broaden its operations.

The corporate’s strategy to borrowing allowed it to proceed rising whereas staying true to its sustainability mission.

This instance highlights how financial institution loans might be helpful for firms. You possibly can finance progress whereas preserving possession and management.

Suggestions for Securing a Financial institution Enterprise Mortgage

- Enhance Creditworthiness: You’ll want a wholesome credit score rating and powerful monetary profile to safe good rates of interest from lenders.

- Be Ready: Collect all vital monetary paperwork and be prepared to supply info to help your mortgage software.

- Borrow Responsibly: Solely borrow what you want and have a stable plan for repaying the mortgage on time.

5. Pre-Promote Your Answer

The quickest strategy to check in case your aspect hustle concept has legs is to ask individuals to pay for it — earlier than you’ve constructed something.

I’ve achieved this for a pair completely different digital merchandise. The method works like this:

- Create a quick description of that the product will probably be

- Ask individuals to pre-order it (usually for a reduced value)

- In the event you get a important mass, then go and construct it

That’s what I did with The Traffic Course, my on-line website positioning course. I stated if I acquired 20 pre-sale orders, I’d go forward and create it. In any other case, I might have refunded everybody.

It makes for a quick-and-easy strategy to validate your concepts with precise {dollars}, so that you don’t waste time creating one thing no person desires.

However should you don’t have an current viewers, it’s important to get a bit of extra artistic, like the instance beneath illustrates.

Actual-Life Instance: John Logar

John Logar is an Australian enterprise guide who believes on this pre-selling mannequin of fundraising. In reality, he pre-sold $120k worth of software — that didn’t exist but — beginning with no viewers in any respect.

His technique concerned speaking with enterprise leaders to uncover costly ache factors, after which proposing to construct the answer.

Suggestions for Pre-Sale Success

- Domesticate Relationships: Belief is vital if you’re asking individuals to purchase a services or products that doesn’t exist but.

- Take Suggestions and Route: Your pre-sale clients can present useful steerage on what options they’d wish to see within the completed product.

- Observe By means of: In the event you don’t ship what you promised, you threat burning your repute for good.

6. Crowdfunding: Flip Believers Into Traders

Just like pre-sales, crowdfunding is a strategy to increase funds by accumulating small contributions from many people. This sort of enterprise finance is often achieved by means of on-line platforms like Kickstarter.

On common, crowdfunding backers pledge $88 per project. So that you want a variety of backers to lift important funds.

There are a number of crowdfunding fashions, together with:

- Reward-Based mostly Crowdfunding: People contribute in change for a tangible perk or product.

- Donation-Based mostly Crowdfunding: Backers don’t anticipate something in return aside from the satisfaction of supporting a trigger or mission they imagine in. Generally used for charitable and social causes.

- Fairness-Based mostly Crowdfunding: Traders can earn monetary returns if the corporate turns into profitable.

- Lending-Based mostly Crowdfunding: Also referred to as peer-to-peer lending, this kind of crowdfunding includes people lending cash with the expectation of being repaid with curiosity over time.

Every kind of crowdfunding serves completely different functions. Choosing the proper kind depends upon the character of your small business and the targets of your fundraising marketing campaign.

Actual-Life Instance: Oculus Rift

Oculus Rift is a standout success story in reward-based crowdfunding.

In 2012, Oculus launched a Kickstarter marketing campaign to fund the event of its groundbreaking digital actuality headset, Oculus Rift. The marketing campaign aimed to lift $250,000.

The promise of an immersive digital actuality expertise captured the creativeness of potential backers. The marketing campaign rapidly gained momentum, surpassing its funding aim inside hours.

By the point the Kickstarter marketing campaign ended, Oculus had raised over $2.4 million from over 9,500 backers.

The success of the marketing campaign attracted additional funding, resulting in Oculus being acquired by Fb for $2 billion in 2014.

Suggestions for Operating a Profitable Crowdfunding Marketing campaign:

- Time Your Marketing campaign Correctly: Plan your marketing campaign launch strategically. Take into account seasonal tendencies and business occasions which will influence your marketing campaign.

- Select the Proper Platform: Analysis crowdfunding platforms to seek out one of the best place to your marketing campaign. Take into account the consumer base, charges, and different elements.

- Construct a Robust On-line Presence: Begin constructing your on-line presence earlier than launching your marketing campaign. Interact with potential backers by means of social media and different channels to get the phrase out.

7. Authorities Grants: Get Monetary Assist

Authorities grants are monetary help given to help startups and small companies. They’re usually used to help financial progress in particular industries and create extra jobs.

There are at present 2,716 grant programs provided by 26 completely different grant-making companies.

Not like loans, these funds don’t should be repaid. That makes them a pretty possibility for entrepreneurs in search of monetary help with out taking up debt.

However there’s no such factor as a free lunch.

Securing a authorities grant to your startup isn’t simple. Every program has distinctive eligibility standards. The applying course of will also be complicated and aggressive.

Actual-Life Instance: Ryvid

In 2022, the electrical motorcyle firm Ryvid acquired a $20M grant from California.

The state wished to put money into clean-energy transportation and help job progress. Ryvid expects so as to add as much as 900 full-time motorbike and lithium battery manufacturing jobs in California.

Suggestions for Navigating Authorities Grants:

- Look ahead to Distinctive Alternatives: Subscribe to newsletters like Danielle Desir-Corbett’s Grants for Creators to maintain up-to-date on grant alternatives.

- Verify Eligibility Standards: Don’t waste effort and time chasing a grant you’re ineligible for.

- Put together a Robust Utility: Clearly state your targets, how you intend to attain them, and the potential influence of your mission. Present proof and knowledge to again up your claims.

- Be Diligent and Affected person: The applying course of could take a while. Be ready to attend and observe up as wanted.

8. Angel Traders: Pitching For Startup Capital

Angel buyers are usually trying to put money into startups with excessive progress potential. They’re skilled entrepreneurs, business specialists, and profitable enterprise individuals with substantial wealth.

These people usually play an energetic position within the firms they put money into. Greater than 50% of angel investors have expertise as entrepreneurs.

They will supply mentorship and helpful business connections that can assist you succeed.

You’ll have to craft a compelling pitch to draw potential buyers. Share your story and dedication to creating your startup profitable.

Authenticity and keenness might be the X-factor that differentiates your pitch from the remaining.

Actual-Life Instance: Airbnb

Airbnb is an iconic instance of angel investor help resulting in huge success.

In 2009, Airbnb founders Brian Chesky and Joe Gebbia struggled to maintain their accommodation-sharing platform afloat. That they had a compelling imaginative and prescient however wanted extra funds to gasoline its progress.

Enter Paul Graham, an angel investor and the co-founder of Y Combinator. Impressed by the founders’ ardour and revolutionary strategy, Graham invested $20,000 in Airbnb.

With the help of Graham and subsequent angel buyers, Airbnb thrived. It’s now a world phenomenon reworking how individuals discover lodging.

The corporate’s valuation has soared to billions, making it one of the vital profitable startups in historical past.

Suggestions for Charming Angel Traders:

- Inform a Compelling Story: Craft a pitch that conveys your imaginative and prescient, the issue you’re fixing, and your startup’s distinctive worth.

- Showcase Ardour and Dedication: Display your dedication and willingness to be taught from skilled buyers.

- Be Persistent: Discovering an angel investor isn’t simple. Get comfy with receiving setbacks and hold pushing.

9. Enterprise Capital: Attracting the Proper Traders

Enterprise capital (VC) companies pool cash from numerous sources to create funds. These VC funds are devoted to investing in startups with excessive progress potential.

Not like conventional financial institution loans, enterprise capitalists need fairness in change for funding.

VC companies usually tackle increased dangers than conventional lenders. They hope to attain substantial returns if the startup succeeds and grows considerably. In 2022, the median deal dimension of enterprise capital-backed firms within the seed stage was $1.55 million.

You’ll want to indicate confirmed market demand and a transparent progress path to draw funding from a VC agency.

Actual-Life Instance: Uber

In 2011, the ride-hailing big was a promising startup with bold progress plans. To realize its lofty targets, Uber secured an early investment of $11 million from Benchmark Capital.

Benchmark Capital noticed the potential in Uber’s disruptive enterprise mannequin and the rising demand for handy ride-hailing companies.

This partnership proved to be a game-changer. Uber expanded quickly and have become a world phenomenon.

Suggestions for Wooing Enterprise Capital Corporations

- Display Traction: Present proof of market demand. That could possibly be a rising consumer base or quickly rising gross sales figures.

- Spotlight Progress Potential: Have a transparent imaginative and prescient for scaling and making a mark in your business. VC companies put money into high-potential startups with bold progress plans.

- Negotiate: Don’t underestimate your value or promote your self brief.

10. Commerce Credit score: Leverage Vendor Relationships

Commerce credit score is a financing association between a purchaser and a provider. The provider extends credit score phrases to the customer, permitting them to buy items on credit score and defer fee to a later date.

This helps companies to maintain their cabinets stocked. They will meet demand whereas preserving money for different important bills.

Commerce credit score is vital to the nationwide and world financial system. In keeping with the World Financial institution, the annual quantity of home and worldwide commerce credit score involves over 40% of world GDP.

You’ll have to construct a powerful relationship with suppliers to safe commerce credit score phrases. It’s not one thing that many suppliers supply first-time consumers.

You’re extra more likely to safe commerce credit score if suppliers see you as a doubtlessly profitable long-term buyer.

Actual-Life Instance: Walmart and Procter & Gamble

Walmart depends on strategic commerce credit score preparations with suppliers like Procter & Gamble (P&G).

P&G extends credit terms to Walmart, permitting the retailer to take care of its stock ranges with out straining money reserves. This implies Walmart can constantly inventory a variety of P&G merchandise on its cabinets.

In return, Walmart gives P&G with a gradual and high-volume buyer. P&G might be assured in its gross sales projections and handle its manufacturing and distribution processes extra effectively.

Suggestions for Nurturing Commerce Credit score Relationships:

- Begin Small: In the event you’re a brand new enterprise, begin with smaller orders to show reliability and construct belief with suppliers.

- Display Progress Potential: Persuade suppliers that providing credit score phrases might be mutually helpful by highlighting sturdy progress potential.

- Construct Robust Relationships: Walmart and P&G didn’t collaborate carefully from day one. It takes time to display reliability and construct the partnership.

11. Factoring and Bill Financing: Flip Unpaid Invoices Into Working Capital

Factoring and bill finance are varieties of enterprise financing that may make it easier to handle money move. You need to use excellent buyer invoices as collateral for funding.

There are a number of variations between factoring and financing.

With factoring, you primarily promote your unpaid buyer invoices to a third-party firm (the issue) at a reduction. The issue will present an instantaneous money sum and gather the shopper fee when the bill is due.

However, bill finance is utilizing your excellent invoices as collateral to safe a revolving line of credit score or a lump sum mortgage. You’ll nonetheless be answerable for accumulating buyer funds.

There are confidential bill discounting options should you don’t need your clients to know in regards to the funding association.

Actual-Life Instance: Coca-Cola and Taulia

Coca-Cola has 1000’s of suppliers and distributors around the globe. Managing that massive community can create money move points.

Coca-Cola turned to Taulia’s bill financing platform to strengthen its provider relationships. Taulia’s platform allowed Coca-Cola to offer early payment options to its suppliers.

Suppliers who wanted assist managing money move may entry sooner funds at a reduced fee.

Bill financing helped Coca-Cola improve its provider relationships. It earned a repute as a supportive associate within the provide chain.

Suggestions for Factoring and Bill Financing

- Analysis Suppliers: There are hundreds of invoice factoring businesses within the US. Discover your choices and examine phrases and charges earlier than signing any contracts.

- Learn the Advantageous Print: Some lenders require minimum-term contracts and have extra charges on prime of the agreed rate of interest.

- Take into account Confidentiality: This may help you retain management over the collections course of and keep a direct relationship together with your clients.

12. Tools Financing: Powering Productiveness for Startups

Tools financing might help companies get the equipment, know-how, and tools they want. It contains various funding choices like short-term loans, tools leases, and rent buy plans.

In keeping with Forbes’ 2023 Business Loan Survey, tools purchases are the second hottest purpose for in search of a enterprise mortgage.

It may be possibility in case your startup enterprise wants tools or automobiles to broaden. You will get what you might want to develop with out stretching working capital too skinny.

There are a bunch of several types of tools finance varieties. You possibly can select from leases and business chattel mortgages to leases and time period loans.

Actual-Life Instance: Computertrans

Computertrans is a number one logistics supplier in Australia. In 2019, they discovered that money move wasn’t maintaining with progress.

Computertrans wanted to broaden its fleet of automobiles to satisfy buyer demand, however didn’t have the money readily available to make that occur.

Tools finance allowed them to accumulate the automobiles they wanted with out paying the total buy value upfront. The lender initially paid for the brand new fleet, with Computertrans making month-to-month repayments.

Suggestions for Making the Most of Tools Financing

- Assess Your Tools Wants: Keep away from financing pointless or extreme tools.

- Perceive Your Funds: Calculate how a lot you’ll be able to afford to repay comfortably every month with out straining your money move.

- Store Round for the Finest Charges: Examine charges from completely different lenders to safe financing on probably the most favorable phrases.

Selecting the Proper Kind of Startup Funding for Your Facet Hustle

There are many funding choices for brand spanking new companies. Every comes with its distinctive benefits and concerns.

Rigorously assess your monetary wants and threat tolerance. It’s additionally essential to focus in your long-term targets when choosing probably the most appropriate financing possibility.

You’ll possible want a funding combine to cowl your long-term and short-term financing wants. A balanced strategy might help mitigate dangers and optimize your monetary technique.

*************

Large because of George Drennan for serving to analysis and draft this submit! George is a freelance writer and skilled on all issues enterprise. He’s captivated with demystifying the complexities of finance and serving to individuals entry info they will use to enhance their lives.