Because the tax deadline approaches, many people discover themselves scrambling to collect required paperwork and finalize their filings.

For those who’re contemplating submitting for a tax extension however are cautious of drawing the IRS’s consideration, concern not—submitting a tax extension is a standard observe and doesn’t mechanically set off an audit.

Listed here are 10 professional suggestions that will help you file your tax extension easily and confidently.

Professional Tip: Scuffling with tax debt? Alleviate Tax works immediately with the IRS in your behalf which might aid you get out of tax debt quicker. Their crew explores choices which will even cut back what you owe. When you have $10,000+ overdue, answer a few questions to see if you qualify today!

1. Know your deadlines

Usually, the cut-off to request a tax extension traces up with the standard tax submitting deadline, sometimes April fifteenth. In 2025, it’s certainly on April fifteenth, so ensure you get your extension request in by then.

For those who don’t make it by this date, you would possibly face penalties or curiosity expenses.

Professional Tip: For those who’re managing investments of $100,000 or extra, make the most of SmartAsset. By filling out a fast questionnaire, you possibly can immediately join with as much as three vetted monetary advisors in your space to assist information your choices.

2. Use Kind 4868

The IRS supplies Kind 4868—Software for Computerized Extension of Time to File U.S. Particular person Revenue Tax Return.

Make sure you fill out this manner precisely to obtain an automated six-month extension. This way simplifies the extension course of, making it accessible to anybody needing additional time.

Professional Tip: Scuffling with greater than $20,000 in unsecured debt? Get skilled assist. National Debt Relief is a trusted supply totally free recommendation and help.

3. File electronically

Submitting your extension on-line is environment friendly and supplies quick affirmation of submission. This reduces the chance of lacking the deadline on account of postal delays or different problems.

It additionally minimizes the chance of kinds being misplaced in transit.

Professional Tip: Shield your hard-earned cash by making certain well timed and safe submissions, then earn as a lot as attainable in your emergency financial savings. For instance, SoFi Checking provides 3.8% curiosity, plus a possible $300 signup bonus. (Charges might change with out discover.)

4. Pay what you owe

An extension to file isn’t an extension to pay. To keep away from penalties and curiosity, estimate your tax legal responsibility as precisely as attainable and pay the quantity due by the unique deadline.

This step ensures you gained’t face extreme expenses in a while.

Professional Tip: There’s no extension for saving for retirement. Begin at this time with matched contributions and watch your cash develop! Join a SoFi IRA to make the most of compounding curiosity and retire comfortably. The longer you wait, the much less you’ll earn. Get started today.

5. Keep away from underpayment

Whereas estimating taxes owed, guarantee your calculations are as correct as attainable. Paying lower than 90% of your whole tax legal responsibility can result in penalties, rising your audit threat.

Try for accuracy to take care of a easy submitting course of.

Professional Tip: Put money into accuracy by consulting the specialists. When you have over $150,000 in financial savings, take into account speaking to knowledgeable monetary advisor. Zoe Financial is a free service that may match you with a professional in your space.

6. Hold detailed data

Preserve documentation of your earnings sources, deductions, and correspondence with the IRS. Good record-keeping can present a protection in case of an audit.

Organized data can even simplify the method of finishing your return later.

Professional Tip: Hold your receipts, particularly for those who want money, debt reduction, or assist funding a significant expense. Discover the very best choices tailor-made to your wants—quick, straightforward, and safe. Explore financial solutions here.

7. Verify your data

Guarantee all data on the shape is right, together with your Social Safety Quantity, tackle, and estimated tax cost.

Easy errors can flag your return for potential overview. Accuracy on this space can forestall pointless problems.

Professional Tip: Avoiding small errors additionally applies to a house fairness mortgage. It’s an excellent possibility for accessing quick money. Earlier than you proceed, take a minute to see how much you can get, how fast you can get it, and how little you’ll pay.

8. Seek the advice of a tax skilled

Consulting with a CPA or tax advisor can present readability and peace of thoughts for those who’re not sure about your tax calculations or submitting process.

They may also help be sure that each facet of your submitting is so as. Skilled recommendation can even present methods that you could be not have thought-about.

Professional Tip: Even with skilled steerage, you would possibly nonetheless battle with funds in retirement. Take into account a reverse mortgage, which might flip your private home fairness into tax-free money for seniors 62+, with no home sale required.

9. Assessment final 12 months’s return

Cross-reference this 12 months’s data with final 12 months’s tax return to establish discrepancies. Important variations would possibly catch the IRS’s consideration and result in additional scrutiny.

This behavior additionally helps establish constant deductions or credit.

Professional Tip: Slightly additional effort and a spotlight to minor particulars could make an enormous distinction. Begin small with simply $1 and diversify throughout shares, bonds, ETFs, crypto, and artwork utilizing this popular app – sign up today. Make investments with zero commissions!

10. Keep knowledgeable about IRS adjustments

Tax legal guidelines and IRS procedures can change regularly. Staying up to date on new tax codes or IRS bulletins may also help make sure you meet all necessities.

Preserving abreast of adjustments prevents surprises throughout tax season.

Professional Tip: Discover diversification choices like treasured metals investments, with alternatives to obtain as much as $10,000 in free metals by certified purchases. For those who’re over 50 and inquisitive about investing in Gold, now is a good time to get your FREE 2025 Gold Information Kit and shield your future with bodily treasured metals!

File your tax extension with confidence

By following these professional suggestions, you possibly can file your tax extension with confidence, minimizing the chance of an IRS audit.

By staying knowledgeable and ready, submitting an extension might be easy and provide the respiration room wanted to navigate tax season successfully.

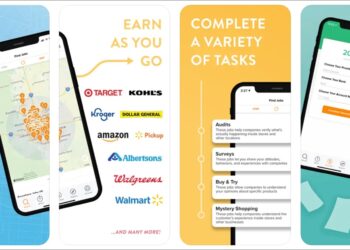

Professional Tip: Give your self a bit of additional money to assist your efforts and earn earnings with minimal effort. Over $55,000 is paid every day to this company’s members who take surveys of their free time.